Infini Resources #I88

Market Cap at 20c: $11.9 million

Enterprise Value: $6.9 million

Sectors: Uranium and Lithium

Top 20: 70%

Company Presentation Link: cdn-api.markitdigital.com/apiman-gateway

Investment Highlights

- The company maintains a relatively modest market capitalization compared to industry peers, having successfully raised over $5 million through its IPO. This substantial cash infusion bolsters the company’s financial position, significantly reducing the reliance on short to medium-term capital requirements. The ample cash reserves garnered from the IPO enhance the company’s financial resilience and provide a solid foundation for executing its business strategies without immediate capital constraints.

- The presence of a seasoned management team with a track record of success, having served on the boards of several junior ASX-listed companies. Their extensive experience also includes roles within some of the largest resource companies globally, contributing valuable insights and expertise to the operational dynamics of the organization.

- Infini is a diversified metals explorer, boasting eight projects strategically located in Tier 1 jurisdictions. This diversified portfolio not only spreads risk but also positions the company in regions known for their stability and favourable regulatory environments. Uranium is one of the hottest sectors at the moment so having exposure to both greenfield and brownfield projects is advantageous.

- The company’s exploration opportunities are backed by highly prospective geology. The company’s ventures are grounded in geologically promising areas, providing a solid foundation for potential resource discoveries.

- The company is strategically positioned within the green energy sector, aligning with the global shift towards sustainability. This positioning is fortified by robust growth projects within its portfolio, capitalizing on the increasing demand for clean energy solutions.

Infini Resources is poised to list with a portfolio comprising eight assets spanning the Lithium and Uranium sectors. However, for the purpose of this analysis, the spotlight will be on the company’s more advanced projects: the Des Herbiers Uranium Deposit, the Yeelirrie North Uranium Project and the Paterson Lake Lithium Project.

These projects represent strategic focal points that warrant in-depth scrutiny and evaluation within the broader context of the company’s asset portfolio. To read more about the Infini’s other assets, visit the company’s website: infiniresources.com.au

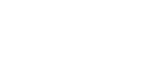

Des Herbiers Uranium Deposit

The Des Herbiers Uranium deposits hosts a JORC 2012 Inferred Mineral Resource of 162 Mt @ 123ppm U3O8 (43.95mlb). This was established via a thorough drill program of >50,000m of drilling conducted between 2007-2009. In addition to this, the deposit had some incredibly high grade Channel samples reaching up to 8,122ppm U3O8.

As of January 2022, Quebec implemented a moratorium on uranium exploration and mining, citing concerns about potential environmental and health impacts linked to uranium extraction. This stance has been shared by other governments globally.

Nevertheless, sentiments are evolving, particularly with the emergence of safer nuclear power plant technologies. If Quebec decides to lift the moratorium, it has the potential to bring about significant shifts in the outlook and valuation of uranium-related assets.

For a peer analysis, let’s briefly examine Cauldron Energy (ASX:CXU) in comparison to Infini Resources. Similar to Infini, Cauldron is focused on advancing its Yanrey Uranium Project, featuring the Bennet Well Deposit with a ‘total Inferred and Indicated Mineral Resource of 38.9 Mt @ 360 ppm U3O8 for 30.9 Mlb.’ This deposit is situated in Western Australia, a region that, like Quebec, has imposed a moratorium on Uranium mining.

Presently, Cauldron is trading with an approximate non-diluted market capitalization of $35,000,000, roughly three times higher than that of Infini Resources. While Infini Resources exhibits a lower grade than Cauldron, the substantial difference in tonnage complicates a direct comparison. It’s crucial to note that the market appears to be reevaluating Uranium micro caps, anticipating potential shifts in the stance of Western governments in the near future.

Another peer comparison we can look at is Elevate Uranium (ASX:EL8) which hosts s JORC resource of 332mt @ 128 ppm U308 in Namibia. The market has valued Elevate with a market cap of ~$127,000,000 at current date (share price of 0.455c). This gives us a much better indication of the value the market could attribute to Infini’s Des Herbiers project as the grades are nearly identical and has about half the tonnage to date.

The uranium sector itself has been experiencing positive momentum, marked by a substantial increase in uranium prices over the last 12 months, it could indeed bode well for uranium-related stocks, including Infini Resources. Rising uranium prices often positively impact companies involved in uranium exploration and production.

Several factors have contributed to the recent upswing in the uranium sector:

- Global Energy Demand: An increase in global energy demand, coupled with a growing interest in cleaner energy sources, may boost the demand for nuclear power and, subsequently, uranium.

- Supply Constraints: Challenges related to uranium supply, such as mine closures or delays in production, could contribute to a supply-demand imbalance, driving up prices.

- Geopolitical Factors: Changes in geopolitical dynamics or shifts in government policies supporting nuclear power can influence the uranium market.

- Investor Sentiment: Positive sentiment among investors, perhaps driven by a renewed interest in nuclear energy as part of the global energy mix, can contribute to the sector’s overall performance.

Yeelirrie North (U) – Western Australia

The Yeelirrie Project encompasses an exploration license, E53/2188, spanning an area of 70 blocks (approximately 220km²), situated approximately 70km southwest of Wiluna, Western Australia. This project is located adjacent to Cameco’s (the worlds largest Uranium producer) state approved Yeelirrie Uranium Project with a resource of 128.1Mlb @ 1500ppm U3O8.

Even though Little exploration work has been done on the Yeelirrie Project, Encounter Resources Ltd (ASX: ENR) executed shallow Aircore (AC) and Reverse Circulation (RC) drilling on the north-western periphery of the tenement, specifically in the exercised area beyond the existing tenement boundaries.

The analysis of potential uranium prospectivity has primarily involved a Radiometric Survey. This survey has revealed notable areas with high potential for uranium presence, aligning in a striking manner from the Northwest to Southeast direction across the tenure.

Over the next 24 months post-Admission, the company plans to conduct a desktop geophysical review and field mapping, followed by a ground-based gravity survey.

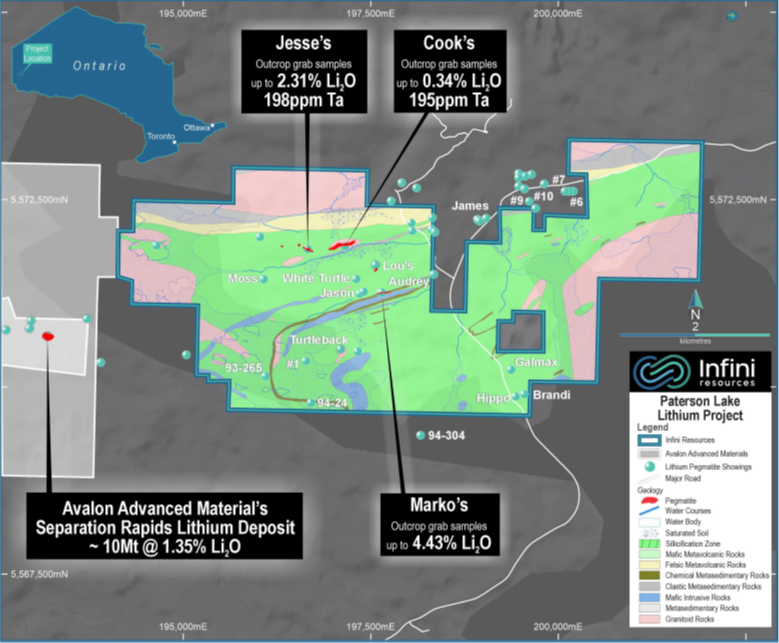

Paterson Lake Project

Sitting on a greenstone belt adjacent to Avalon advanced materials Separation Rapids deposit which hosts ~10Mt @ 1.35% Lithium. This project recently saw a $63m joint venture kick off with Antwerp-based Sibelco. This joint venture aims to ‘own and work to commercialize and generate revenue from the mineral assets.

The Paterson Lake Project has been documented to contain abundant rare-metal bearing pegmatites including 7 named petalite bearing pegmatites and up to 50 unnamed pegmatites that require investigation.

Two mineralised pegmatites will be the focus of the company’s exploration in 2024 with two pegmatites which were rediscovered during a 2018 prospecting program called the Marko’s pegmatite and Jesse’s pegmatite. Excitingly, the Markos pegmatite had a high-grade outcrop grab samples up to 4.43% Lithium.

In 2023, the lithium sector faced challenges, primarily driven by concerns about a potential oversupply of lithium in the coming years. Despite these issues, it’s essential to recognize that a green energy revolution is reliant on lithium, and recent fluctuations in the market are unlikely to mark a prolonged downturn. As the lithium industry progresses and reaches a level of maturity, the significant fluctuations in investor sentiment are expected to gradually stabilise.

What to expect in the short term?

The central aim of the company in the short term is to systematically identify and document a selection of premium exploration targets encompassing both uranium and lithium deposits across the Portland Creek Uranium, Paterson Lake Lithium, and Tinco Uranium projects.

This strategic initiative involves a comprehensive assessment of geological and geophysical data to pinpoint areas of high potential for valuable mineral resources. This approach aligns with a forward-looking strategy to maximize the exploration success and resource potential of these valuable mineral assets.

You can read more about the Portland Creek and Tinco projects that weren’t discussed in this article here: cdn-api.markitdigital.com/apiman-gateway

Risks

- An inherent risk associated with any exploration-focused company lies in share price volatility, with success hinging significantly on drill results. The exploration outcomes play a pivotal role in shaping investor sentiment and, consequently, the company’s market valuation.

- Acknowledging the need for future capital infusion, it’s crucial to note that the success in achieving company milestones is pivotal. Meeting these milestones is anticipated to elevate the capital raise price well above current levels, offering a potential return for investors. Additionally, the success of capital raising efforts is intricately tied to the prevailing market conditions. Given the unpredictable nature of future market environments, it becomes challenging to accurately estimate or forecast the conditions under which future capital will be raised.

- It’s essential to note that commodity markets, including uranium, can be volatile and subject to various external influences. Investors should carefully monitor market conditions, geopolitical developments, and industry trends to make informed decisions. Additionally, the past performance of a sector or stock doesn’t guarantee future results, and risks should be assessed based on the current economic and market environment.

In the interest of full transparency, Phoenix Global or its associates own a significant amount of shares in Infini Resources in addition to the shares purchased in the $50k challenge. Infini Resources is also a client of Phoenix Global Investments & Phoenix is paid a fee by all stocks mentioned. No information is personal financial advice & all information is general in nature. Please remember all content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on this Website and wish to rely upon, whether for the purpose of making an investment decision. The research provided in this article is considered to be reliable and is accurate as of the publication date.

Ongoing Research Articles

Infini Resources Investment Report

Infini Resources: Shaping Tomorrow's Energy with Uranium Overview: Infini Resources is an ASX-listed exploration company focused on the high-growth lithium and uranium markets. With a portfolio of [...]

Stunning High Grade Uranium Soil Results at Portland Creek

Company – Infini Resources Ticker – ASX:I88 Sector – Uranium / Lithium Initial Investment Thesis – https://phoenixglobalinvestments.com.au/infini-resources-asxi88/ “Some Of The Highest Uranium Soil Grades Returned Globally” Infini Resources (I88) [...]