Brightstar – Australia’s Newest Gold Producer

Since our last update in November 2023 (Brightstar November 2023 Update X), BTR has been achieving milestone after milestone, including delivering on becoming Australia’s newest gold producer which has been reflected in the increase of the company’s share price.

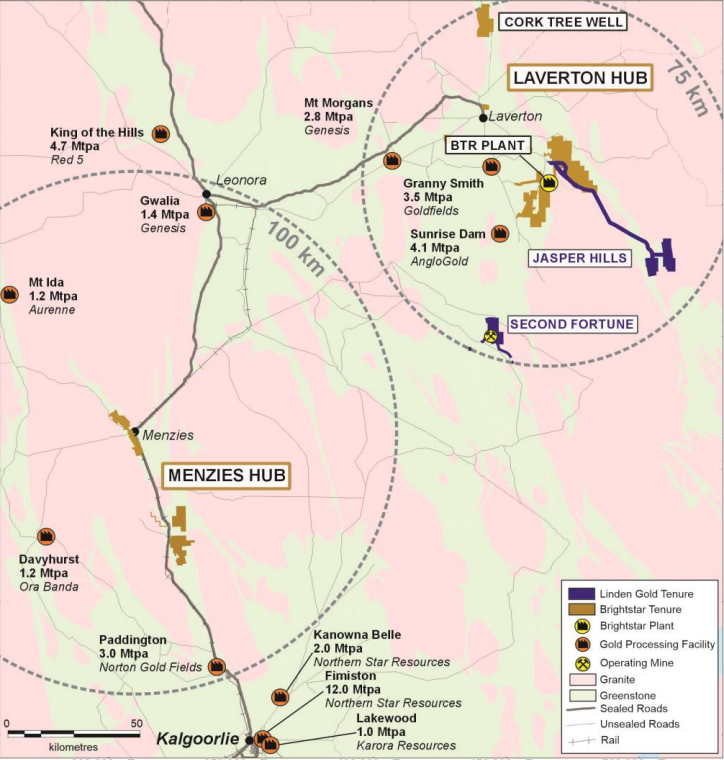

Notably since our last update, BTR have just announced it is acquiring unlisted gold producer Linden Gold Alliance via an unanimously recommended off-market scrip takeover offer, with a robust portfolio of exploration and production assets within the Laverton Hub.

What’s The Upshot?

Linden is a private gold producer, developer and explorer with existing mineral resources of 350koz @ 2.1g/t Au near BTR in the Laverton district, and post merger would see BTR with a revised total mineral resource of 1.4Moz @ 1.6g/t, market cap of $66m, $22m in cash and $0 debt.

Under the offer, Linden securityholders will receive 6.9 BTR shares for every Linden share they hold and 6.9 BTR options exercisable at 3.6c each, implying an undiluted equity value for Linden of approximately $23.7m.

Why Merge?

The merger with Linden is aligned with BTR’s strategy to rapidly become a mid-tier gold producer from two of West Australia’s most prolific regions, Laverton and Menzies.

The transaction delivers BTR with;

- Scale & Diversification – logical consolidation of two highly complementary resources bases that adds scale while maintaining a disciplined focus on mineable ounces

- Production Growth – immediately create an operating gold producer (+20koz Au produced in FY24 YTD) and put’s BTR on a low risk, low capex path towards ~100koz per annum

- Critical Mass – increased resource base of 1.4Moz provides the critical mass to de-risk the potential restart and upgrade of the BTR plant to ‘bring forward’ production ounces and greater flexibility for development scenarios.

- Synergies – unlocks geographical and operational synergies with proximal assets connected by privately owned haul roads. Enhanced operational capability with two production assets

- Enhanced Board & Management – strengthened executive team with significant experience and track record of success

- Balance Sheet – BTR to emerge with approximately $22m of cash and nil debt (pre costs of the offer).

Second Fortune Project – No CAPEX & Currently Producing Organic Cashflow

Through the merger BTR will acquire the ‘Second Fortune Project’, which contains an underground gold mine with a JORC Resource of 58koz @ 10.9g/t, located south of Laverton. FY24 year to date, Linden has produced more than 13,000oz Au, with ore processed through Genesis Minerals Ltd’s Gwalia processing facility (where BTR’s recent Selkirk joint venture was toll treated).

What we like here is that BTR acquires an operating gold mine with no CAPEX requirements, providing immediate cash flow for the company. Linden brought Second Fortune out of care & maintenance in 2021 and a significant amount of capital has been spent to get the mine into production.

Further, mineralisation remains open at depth with limited drilling within the Second Fortune mine below the current mine plan, or on land proximal to the mine despite an abundance of historical workings, visible quartz outcroppings and showing similarities to some of WA’s largest underground mines.

The Project also contains several high-grade open pit targets, identified to bolster the mine’s output.

We view this as a potential free swing, with the project funding its own resource growth and greenfield exploration.

BTR Exploring Further Organic Cash Flows at Menzies – Link Zone

BTR have stated that they are “continuing to advance the Link Zone deposits at Menzies as a potential additional small scale mining campaign at Menzies that can be executed contemporaneously with the exploration and development workstreams.”

“Open pit optimisations are currently ongoing in parallel with relevant permitting and approval processes for potential expedited development.”

Much like the Selkirk JV, we see a potential JV for the ‘Link Zone’ as a further opportunity to generate more non-dilutive cash flow within in the near term.

Development Ready Jasper Hills Project – The Jewel in The Crown

Acquiring Linden will also add the development-stage Jasper Hills project to BTRs portfolio, which has a resource of 4.9Mt @ 1.8g/t for 293koz of contained gold.

The Scoping Study to support the project demonstrates robust financials, and offers synergies to BTRs existing strategy focused on expedited gold production time frames, a low capex, and high returns approach.

- Ready to mine with a rapid restart: first gold within six months of final investment decision.

- Only 48% of the current MRE included in the production target.

- Assumed gold price of A$3,000/oz – currently at ~A$3,300.

- Pre-production capex of $12m

- Net Present Value (unlevered, pre-tax, 8%) of approximately $99m

- Internal Rate of Return – 736%

- Open pit & underground operations

- Production of 141koz over 4 years (35koz pa)

- Significant upside to extend mine life with known resources.

Geographically Complementary Assets

The consolidation of both Jasper Hills & Second Fortune into BTRs existing portfolio not only bolsters BTRs total resource tonnage, but it also offers excellent synergies as they are strategically located proximal to both:

- Hungry 3rd party processing infrastructure (including some on care and maintenance)

- Within 50km and 70km respectively of BTRs existing processing facility.

Both options offer significant cost advantages to BTR, controlling approximately 850koz within the Laverton mining hub, allowing quick processing of ore and reducing the required CAPEX with existing infrastructure already in place.

BTR Shaping Up as A Potential Takeover Target?

Expanding upon the strategic consolidation of these geographically complementary assets, BTR will own 15Mt @ 1.8g/t Au (850koz Au) within short trucking distance to hungry processing plants, namely Genesis Minerals’ ($2B MC) Mt Morgans operation which is currently on C&M.

With Mt Morgans having a headline throughput of 3Mtpa, and their Redcliffe Project (7.2Mt @ 1.1g/t) & Jupiter Project (24Mt @ 1.1g/t) deposits going through mining studies and not forecast to be in operation until FY26, BTR’s Jasper hill, Cork Tree Well and Second Fortune deposits which can be in production by FY25, could all provide potential feed sources as Mt Morgans restarts.

Genisis have stated they are ‘Open for Business’, noting their hunger for growth through M&A. Genisis have been quite active in the M & A space recently, primarily in the Leonora (~100km from Laverton) District, including:

- In Apr 2023, St Barbara agreed to sale of their Leonora Assets to Genesis Minerals for total consideration of $600 million. St Barbara are now BTRs biggest shareholder.

- In Dec 2023, acquisition of Kin Mining’s Bruno-Lewis & Raeside Gold projects (610koz) for $53m

De-Risking Restart of BTR Plant & Increasing Capacity

Recently, BTR’s processing plant and infrastructure had an independent replacement valuation of $60m, with a required capital expenditure of $18.5m to upgrade and refurbish (480ktpa).

The increased resource base of 1.4Moz provides the critical mass to de-risk the potential restart, upgrade the plant and ‘bring forward’ production ounces, and provide greater flexibility for development scenarios.

BTR’s current mine plan delivers +5 year Life of Mine (LOM) to this infrastructure, however with the increased resource base delivered from the Linden acquisition, it offers significant scope to increase mine life and gold production profile per annum through.

- Access to increased mined head grades from underground mines (Second Fortune, Fish)

- Increased material feed qty

Furthermore, BTRs mill is the closest available mill to Linden, potentially significantly lowering haulage and processing costs compared to third party agreements.

BTR are assessing options for increasing throughput to 1Mtpa in the combined Pre-Feasibility Study to significantly increase production profile, which we see offering meaningful cost advantages and increased profitability.

Clear Pathway to Low CAPEX Mining +100Koz

Based on a conceptual combination of BTR & Linden Scoping Studies, it demonstrates a strong resource base, low infrastructure and capital costs with ~100koz pa production output possibilities.

We believe management’s low capital approach offers many advantages which include:

- Lower funding hurdle to get into production (not stuck in the ‘development queue’)

- Improves financing strategy & reduces impact of debt and hedging

- Better financial returns on investment

- Accelerated and deliverable pathway to meaningful production profile

To demonstrate just how successful BTRs low capex approach to production can be, parallels can be drawn with Ora Bandas ‘Davyhurst’ Project, which outlined similar financial and production numbers within their DFS & ‘Regional Growth Strategy’.

Ora Banda highlighted their DFS was underpinned by an existing 1.2m tonne per annum processing plant, which is reflected in the project’s extraordinarily low CAPEX figure of just AUD$45m that significantly reduced the company’s risk when moving into production.

Ora Banda is now a meaningful mid-tier gold producer within just 4 years after the DFS was released and capped just shy of $500m.

| Brightstar (ASX:BTR) Combined Scoping Study | Ora Banda (ASX:OBM) DFS at 30 June 2020 | |

| Market cap | $66m | $151m (market cap now $488m) |

| Resource | 1.4Moz | 2.1Moz |

| Capex | $34m | $45m |

| LOM | 0.45Moz over 8 years | 0.41Moz over 5 years |

| Peak production | 98koz | 95koz |

| Pre-Tax Free Cash Flow | +$400m | $357m |

| IRR | 79-110% (TBA) | 109% |

| Spot Price Assumption | $3,200/oz | $2,550/oz |

BTR have advised a strategic review of the combined asset base, development plan and integrated Pre-Feasibility Study is anticipated to be completed by 2H 2024, which will also include a plan to increase their annual production profile.

We view this a significant share price catalyst, as we expect the PFS to exceed expectations with proposed synergistic merger, increase of the gold price in conjunction with the before mentioned low capex strategies.

Post Merger – Where Does BTR Place Amongst Junior Gold Producers?

| Brightstar (ASX:BTR) | Calidus Resources (ASX:CAI) | Beacon Minerals (ASX:BCN) | Catalyst Metals (CYL:ASX) | |

| Market Cap | $66m | $87.6m | $90.1m | $145.3m |

| Enterprise Value | $44m | $131.1m | $85.4m | $168.9m |

| Cash | $22m | $17.5m | $14.4m | $19.4m |

| Debt | $0 | $61m | $9.7m | $43m |

| Total Resource | 1.4Moz @ 1.6g/t | 1.5Moz @ 1.28g/t | 318koz @ 2g/t | 2.1Moz @ 2.9g/t

0.5M oz @ 3.7g/t |

| Production (Dec Q/23 Annualised) | 20koz | 48koz | 27koz | 114koz |

| Stage | PFS | DFS | PFS | DFS |

Post merger, BTR clearly represents value amongst its peers boasting the most cash, lowest EV (by almost half its closest peer), $0 debt and the lowest market cap.

Theoretically, even if BTR debt funded their entire $34m CAPEX requirement, the company would still maintain the lowest EV whilst also increasing their production capacity upwards of ~100koz pa.

100koz Production Target – Established Peer Comparison

| Brightstar (ASX:BTR) | Pantoro (ASX:PNR) | Alkane (ASX:ALK) | Ora Banda (ASX:OBM) | |

| Market Cap | $66m | $333m | $356m | $488m |

| Enterprise Value | $44m | $344m | $306.8m | $479.8m |

| Cash | $22m | $50m | $61.3m | $19.2m |

| Debt | $0 | $61m | $12.1m | $11m |

| Total Resource | 1.4Moz @ 1.6g/t | 4.9Moz @ 3.2g/t | Resource – 1.7Moz @ 1.9g/t

Reserve – 0.6Moz @ 1.7g/t |

1.8Moz @ 2.7g/t |

| Production (Dec Q/23 Annualised) | 21koz (FY24 YTD) | 73koz | 53koz | 65koz |

| FY25 Production Guidance Target | ~100koz (FY26) | +100koz | +100koz | +100koz |

| Location | Laverton & Menzies, WA | Norseman, WA | Tomingley, NSW | Menzies, WA |

If BTR can deliver on their mine plan, targeting up +100kozpa, which will be outlined in the consolidated PFS and DFS, BTR offers significant growth potential in shareholder value through operational delivery of substantial production run-rate.

As shown in the peer analysis, gold producers with production between ~50koz & ~70koz currently offer between 500% to 700% upside.

Cap Structure Review Post Merger & Credible Third Party Validation

By our calculations, BTR shares on issue (SOI) post merge will be approximately 4.7b. This does not particularly concern us as BTR management has indicated a 50-for-1 share consolidation post successful completion of the merger.

We believe it is significant from a value investing perspective, that management have maintained a low market cap & EV relative to its peers in addition to bolstering the companies cash balance without debt as it moves through one of the most difficult periods of a junior minor’s life cycle.

Additionally, the merger and raise received strong cornerstone support from BTR and Linden’s major shareholders Collins Street Asset Management and St Barbara (who will hold 13% of BTR post merge) for a total $4.3 million of the Placement. Prominent mining investment house ASX-listed Lion Selection Group (ASX:LSX) also committed to $2 million in the Placement. The continued support from Collins Street Asset Management and gold miner St Barbara, as well as Lion Selection’s significant investment, all provide important technical and credible third party validation for Brightstar, the merger with Linden and the development strategy articulated by Brightstar management.

With these new and existing substantial shareholders, we believe the holdings of the Top 20 register should meaningfully increase, creating a strong core holding of supportive and long-term shareholders.

BTR Strengthens Board

If the Offer is successful, BTR will appoint three highly experienced mining executives with a track record of success and industry experience in various capacities, which will greatly compliment BTRs transition to a meaningful producer. In our opinion these appointments are one of the highlights of the merger as Brightstar brings on industry professionals with significant mining, financing and operational experience.

- Richard Crookes (Chairman) – Over 35 years’ experience in the resources and investments industries. A Geologist by trade, has previously worked as the Chief Geologist and Mining Manager of Ernest Henry Mining in Australia (Now Evolution mining – $7B mc). Mr Crookes is also Managing Partner of Lionhead Resources, a Critical Minerals Investment Fund and formerly an Investment Director at EMR Capital. Prior to that he was an Executive Director in Macquarie Bank’s Metals Energy Capital division where he managed all aspects of the bank’s principal investments in mining and metals companies.

- Ashley Fraser (Non-executive Director) – Experienced mining executive who founded both Orionstone (which merged with Emeco in 2016 for $686 million) and Blue Cap Mining, an open pit mining services company.

- Andrew Rich (Executive Director) – Qualified Mining Engineer with a strong background in underground gold mining with experience predominantly in the development of underground mines at Ramelius Resources (ASX:RMS – $2B mc) and Westgold Resources (ASX:WGX – $1.2B mc).

CY24 Share Price Drivers – Well Funded to Accelerate Activities

Along with existing cash, proceeds from the Selkirk mining operations and the Placement, BTR will emerge with over $22 million cash (no debt) which will underpin the next phase of activities at BTR’s Menzies and Laverton Gold Projects, including:

- Drilling to deliver UG mine life extension at operating Second Fortune mine.

- Drill out and de-risk early mine plan:

- Lady Shenton OP (Menzies),

- Fish UG and Lord Byron OP (Jasper Hills, Laverton)

- Completion of an integrated Pre-Feasibility Study (PFS)

- Increase global resources & delineate new targets.

CY25 Share Price Drivers

Focus on mine restart and new discoveries.

- Deliver on the mine plan that will be outlined in the consolidated PFS and DFS, targeting up to 100kozpa. Targeting making Final Investment Decision in CY25

- Exploration across the underexplored tenure in LGP and MGP

- Focus on brownfields MRE growth (increased mine life) and new greenfield discoveries

Company Risks

As BTR ramp up their production and feasibility studies, the company will be subject to new risks as noted below:

- Funding / Dilution – BTR is reliant on additional funding to secure pre-production CAPEX and complete full mine commissioning should they opt to use their existing processing plant. It is not yet clear what form this funding will take, and there is no guarantee that funding will be achieved.

- Project delays and cost overruns – Pending feasibility studies, BTR’s ability to develop and potentially commercialise new projects on schedule may be affected by factors including project delays and cost overruns.

- Pre-production and plant capital – the capital costs required to restart the Company’s existing processing plant and mining operations at Laverton have been scoped and estimated to cost approximately $18.5. This capital cost to restart the project is an estimate only and such capital costs may vary.

- Lower than forecast commodity price (A$) – A prolonged suppression of the gold price or a substantial strengthening of the Australian dollar has the potential to reduce the Project NPV.