Company: Pioneer Lithium

ASX Ticker: PLN

Sector: Lithium / REE

PLN Secure 730km2 of Prospective Ionic Clay Rare Earth Tenements In Hot Region of Brazil

Our ~$7M capped explorer Pioneer Lithium (PLN) announced on the 4th April, 2024 that they have secured ~730 km2 of tenements in the Bahia State of Brazil, with compelling potential for clay-hosted rare earth deposits.

Interestingly, the State of Bahia in Brazil is also home too other ASX listed REE explorers including Equinox Resources (ASX:EQN) capped at ~$22M who recently announced their district scale REE discovery at their Campo Grande project in addition to Brazilian Rare Earths (ASX:BRE) capped at ~$530M, who have had a stellar run after recently listing with a JORC resource of 510Mt @ 1,513ppm TREO at their Rocha da Rocha project.

We see this as a positive development, considering the increased interest from big players in this specific region of Brazil and with such a modest market cap, PLN could easily catch some momentum off the back of its larger capped peers should they have any success.

Verde Valor Project Exhibits Favourable Geology For IAC Discovery.

PLNs ‘Verde Valor’ project lies within a major coincident thorium-uranium radiometric anomaly, and the local geology exhibits promising indicators for rare earth mineralisation within this geological setting.

The combination of volcanic activity and weathering processes present at Verde Valor are some of the specific geological conditions conducive to IAC formation.

PLN have already undertaken a site visit which has confirmed the presence of highly weathered saprolite clays presenting a favourable geological setting for critical mineral discoveries.

PLN Have Secured A District-Scale Project to Themselves

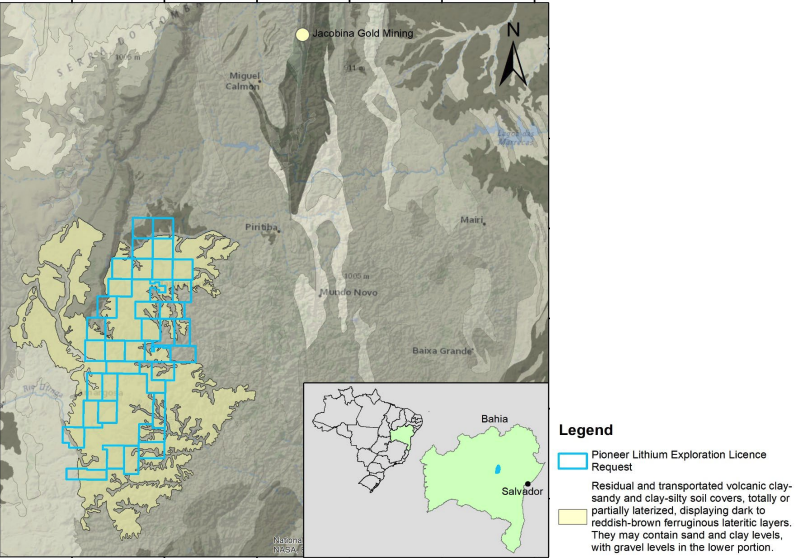

The formation of IACs is marked by a combination of residual and transported soil from volcanic sources, forming clay-sandy and clay-silty soil layers.

As depicted in the below image, PLN have a first movers advantage and have secured 730km2 of this prospective geology in their tenement package, providing potential for a district scale discovery on any exploration success.

Why Secure A Strategic Rare Earth Tenement in Brazil?

Interestingly, PLN Non-Executive Director, Agha Pervez also sits on the board of Viridis Mining Minerals (ASX:VMM) & Equinox Resources (ASX:EQN), both of which have made recent Rare Earth discoveries in Brazil.

We know Mr Pervez has been spending a lot of time in Brazil and has a proven history of securing some of the most prospective tenement packages in the region as highlighted by EQN & VMM.

So why secure more land? Well, it actually makes complete sense:

- EQN & VMM have enough prospective projects in Brazil to keep them busy for years

- Securing the ‘Verde Valor’ project brings another prospective IAC project into his stable of winners

- It locks up more prospective tenements in this hot region, reducing ability for competitors to enter

- Creating a collective of IAC Rare Earth powerhouse

Attractively, PLN appears to be following an almost identical playbook to EQN & VMM, with the only difference being it is starting from a lower market cap, making a much larger re-rate a possibility.

With Mr Pervez’s recent track record and expertise in the Rare Earth industry, we are confident he can take PLNs project forward in a similar fashion to its other stable mates.

| PLN | EQN | VMM | |

| 4-week Av Share Price Before Brazil Project Acquisition | $0.145 | $0.18 | $0.23 |

| Time Between Now & Acquisition | 1 day | ~3 months | ~7 months |

| Share Price Today | $0.165 | $0.22 | $1.08 |

| Share Price Accretion | ~13% | ~20% | 370% |

| Project Stage | *Field works | *Channel samples discovery made

*Maiden drill campaign to commence |

*Drilling assays discovery made

*Currently drilling *Developing MRE |

| Next Share Price Catalyst | *Channel samples | *Drilling results

*Met work |

*MRE

*Met work |

We Can’t Forget About PLNs Other Projects

PLN already boasts some of the most prospective Lithium projects in Canada, which we analysed in detail in our initial company investment thesis – Pioneer Lithium – Investment Thesis.

- Root Lake Project – Confirmed spodumene-bearing pegmatite outcrops & contiguous to Green Technology Metals (ASX:GT1) two existing deposits, Root Bay (10Mt @ 1.29% Li20) and McCombe (4.5Mt @ 1.01% Li20).

- Benham Project – 40m Spodumene bearing pegmatite discovered with assay results from channel sampling showing grades up to 4.61% Li2O

- LaGrande – Nine (9) pegmatite outcrops discovered at LaGrande East and West

PLN Poised For A Re-Rate

What we find most advantageous about this acquisition is that management have now exposed PLN to another commodity sector, which is forecast to see strong demand.

With PLNs collective of prospective assets, market cap (as we write this) of just ~7M , $2.8M cash on hand at 31st Dec, tiny EV of $4.2M in conjunction with 80% of shares locked up by a steadfast Top 20, any positive news at either of their projects will have the potential to be explosive due to limited availability of shares.

What’s Next for PLN?

- Maiden drill campaign at the Root Lake Project – PLN have confirmed they are finalising preparations for this campaign

- Commence fieldworks campaign at LaGrande Project

- Planning next steps at Benham Project