Company: Battery Age Minerals

Ticker: BM8

Sector: Germanium-Gallium / Lithium / Copper

What Does BM8 Do?

BM8 is a multi-asset junior explorer, currently growing its Falcon Lake Lithium Project in Ontario, Canada, which has intercepted multiple high grade spodumene lithium intervals up to 31.75m from shallow depths.

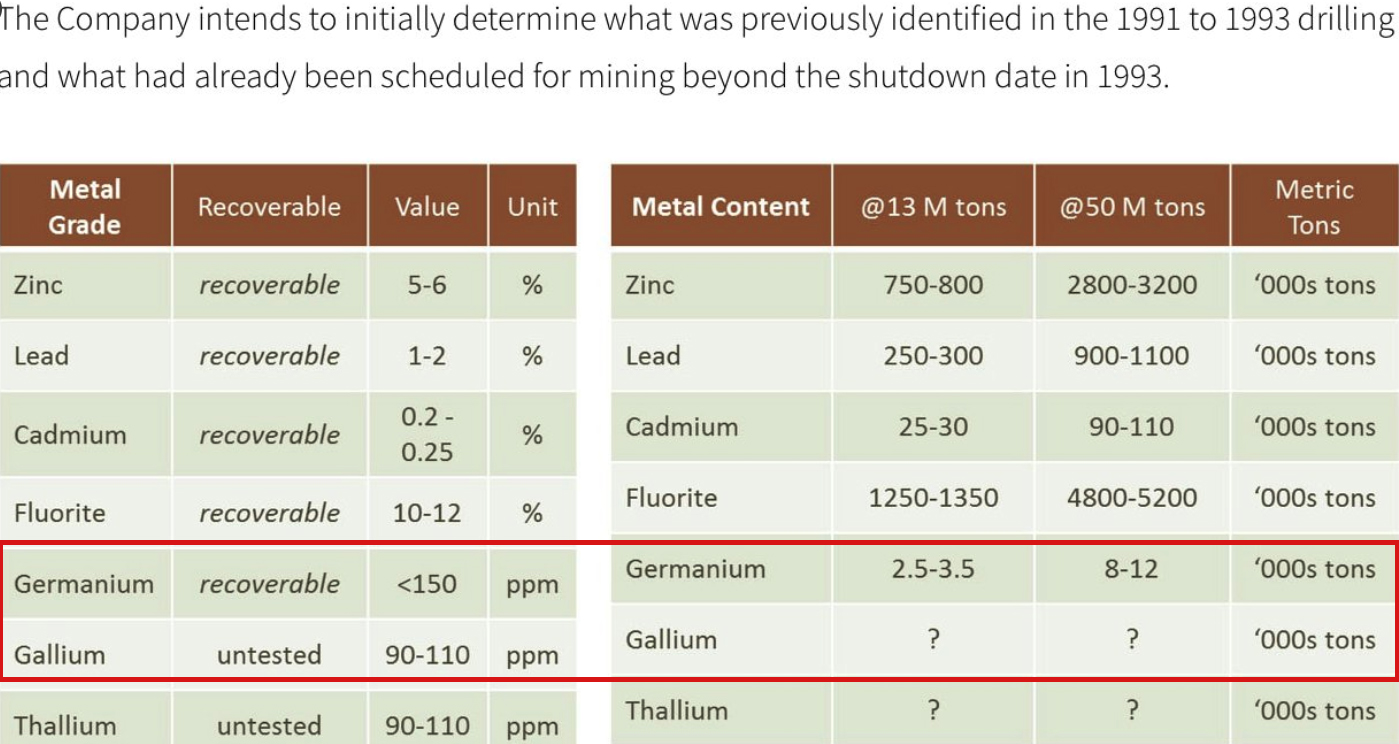

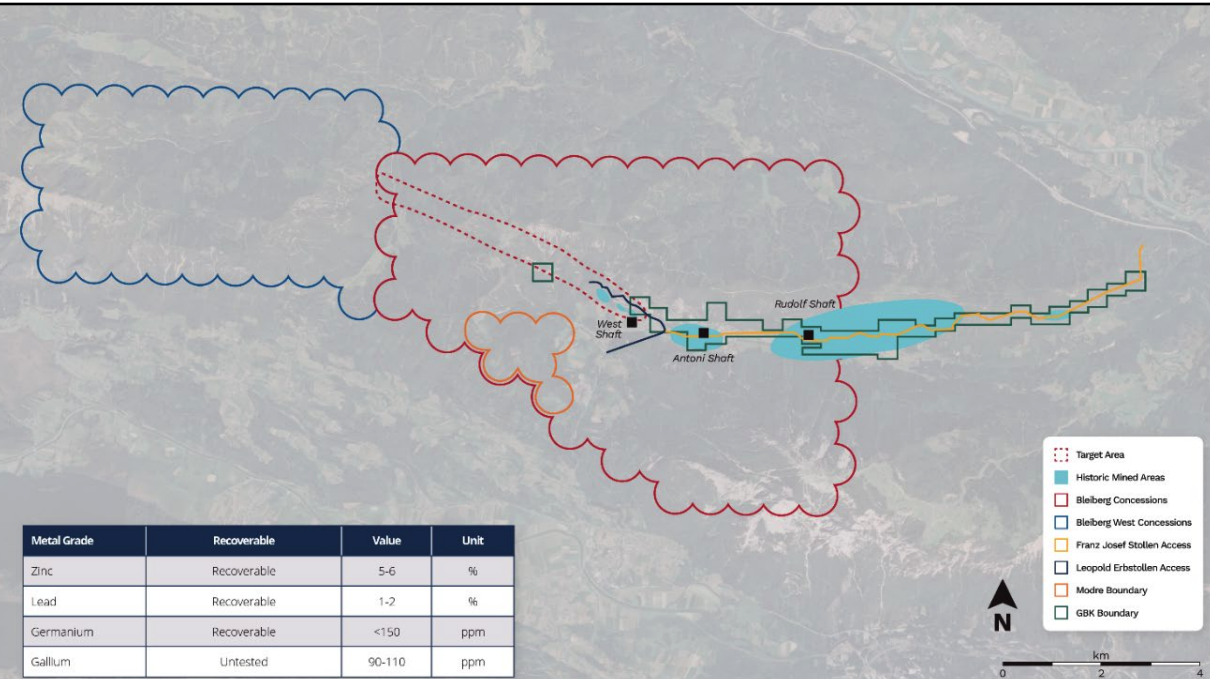

Recently, BM8 has also concurrently been progressing their Bleiberg Zinc-Lead-Germanium Project in Austria, which has some of the world’s highest reported Germanium grades (200g/t) as well as proven Gallium mineralisation (90-110g/t).

Recent Performance

Not too dissimilar from a lot of ASX listed junior exploration companies over the past 12 months, BM8 has faced a challenging broader market sentiment, with lithium prices taking a large decline after hitting all-time highs.

Despite BM8 having a successful drill campaign at their Falcon Lake project, returning impressive spodumene bearing drill intercepts, the share price has dwindled correspondingly with the lithium sector.

What is The Sector Thematic?

With the lithium sector enduring some short-term head winds, we think it is perfect timing for BM8 to ramp up exploration at their prospective Bleiberg Zinc-Lead-Germanium Project.

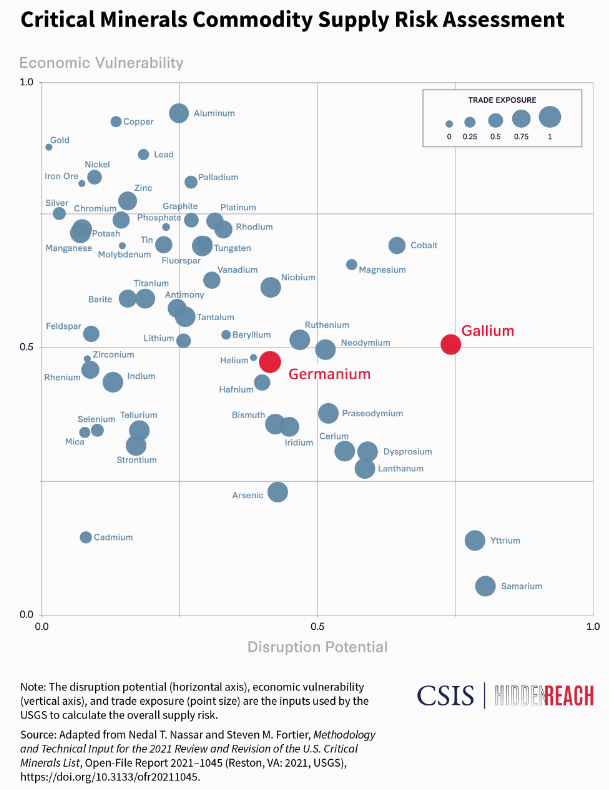

Germanium & gallium have both become essential materials to develop new generation semiconductors and chips which are used within Electronic Vehicles, Artificial Intelligence and Quantum Computing.

Currently the U.S is 100% import dependent on gallium and 50% import dependent for germanium.

Moreover, the European Union, imports 71% of its gallium and 45% of its germanium from China.

It’s another stark reminder to the world of China’s dominance in the production and processing of key minerals.

We believe this presents some high potential catalysts driven by the ever-omnipresent risk of National Security.

What Do We Like About BM8?

Small Market Cap & Tiny EV

As of writing this, BM8 is capped at just $10M, with $3M in cash, plus 35M shares in ASX:EQN valued at $7M, giving BM8 a modest $0M EV.

6th Largest Germanium Project in The World.

The historical Bleiberg Zinc-Lead-Germanium mine located within BM8s tenement was ranked as 6th largest germanium mine in the world producing ~172 tonnes of Germanium at only a portion of the Bleiberg mine. Grades are reported upwards of 200g/t.

Although not historically produced at Bleiberg, Gallium mineralisation has also been identified in the historical workings, with grades ranging between 90-110g/t.

BM8 have a 15% interest in the project with a right to earn up to 80% & 100% of newly staked claims.

The Best Exposure to Germanium & Gallium on the ASX

From our research, BM8 is the only investment worthy germanium & gallium play on the ASX.

Whilst there were one or two other ASX listed junior explorers with drill results which returned germanium & gallium, these were extremely low grade in comparison to the historical production grades at the Bleiberg Zinc-Lead-Germanium mine.

Fast & Cost-Efficient Determination of Exploration Targets

BM8 have recently gained access to over 100 years of historic mining data from the Bleiberg Zinc-Lead-Germanium mine.

The data will help the Company to fast-track strategically targeted extensions of the known mineralisation on its tenements.

The Best Place to Find Discoveries is Near Discoveries

Junior exploration is risky at the best of times, however when you can find a project which skews the reward in your favour with favourable geology, it greatly increases your chance of success. BM8 is a perfect example of this, with a confirmed historic economic ore body, with continuing mineralisation trends located within the project tenements.

What’s more promising is following a site visit and some early desktop studies, BM8 management have moved swiftly to peg more land (clouded blue below). Obviously management believe this additional tenement is worth securing for good reason.

We believe BM8 displays all the hall marks of a promising nearology play.

Federal Government Incentives

The US government, amongst others, is looking to incentivise critical minerals production outside of China.

For example, In 2023, the Biden administration asked Congress to amend the law to add Australia and the UK to the Title III provisions of the Defence Production Act (DPA), which authorizes investments in certain commodities and resource sectors, including gallium and germanium, when particular requirements are met.

We see this trend continuing, as governments from all over look to decrease their dependence on China for critical minerals.

Tensions Continue To Rise Between, China, Europe & the U.S.

Over the past several years, we continue to see the largest economies of the world, tighten and restrict exportations between themselves and China.

The most recent example of this saw China place conditions on the export of both gallium & germanium, rocketing prices for the metals up over 300% in July 2023, before the export controls took effect in August 2023.

Nations Are Ramping up Their Chipmaking

Governments are driving initiatives to increase their domestic semiconductor industry which is required to remain globally competitive and move away from their reliance on China.

For example, the European Union has approved the European Chips Act, a 43-billion-euro subsidy plan to double its chipmaking capacity by 2030

Further, Taiwanese chipmaker TSMC has committed 3.5 billion euros ($3.8 billion) to a factory in Germany, its first in Europe, taking advantage of huge state support for the $11 billion plant as the continent seeks to bring supply chains closer to home.

BM8s Bleiberg Zinc-Lead-Germanium project in Austria is perfectly positioned to take advantage of these stimulus packages.

Will History Repeat Itself?

China have implemented a complete exportation ban on critical minerals in the past.

In 2010, China restricted export quotas of rare earths to Japan following a territorial dispute between the countries.

This saw REE prices rocket and ASX stocks followed suit. Lynas (ASX:LYC) share price for example, grew from ~$4.50 in late 2009 to ~$24.50 in mid 2011.

Does this mean it will happen again? No, however given the current circumstances, if the possibility of a ban is even threatened by China, BM8 is one of a few listed companies on the ASX with germanium & gallium in their portfolio, so they could catch the tailwinds of a lifetime.

BM8 Are Exposed to Multiple Critical Minerals

BM8 boast an impressive portfolio which contains exposure to several critical mineral projects in Tier 1 jurisdictions. This diversified portfolio not only spreads risk but also positions the company in regions known for their stability and favourable regulatory environments.

Some of these projects include:

1. Falcon Lake Lithium Project, Ontario Canada. Significant drill interceptions include:

- 31.75m @ 1.45% Li20 from 14.65m depth

- 29.75m @ 0.81% Li20 from 46.3m depth

- 27.6m @ 1.37% Li20 from 16.65m depth

- 21.9m @ 1.44% Li20 from 5.7m depth

2. Tidili Copper-Gold Project, Tidili Morocco. Significant rock chip assays:

- 2.11% Cu

- 1.75% Cu

3. 35% Shareholder of ASX:EQN (Shares valued at $7M). EQN projects include:

- Hamersley Iron Ore Project, WA – JORC Mineral Resource of 343 at 54.5% Fe

- Camp Grande Rare Earth Project, Brazil – Tenements adjoining ASX:BRE ($538M market cap). Drilling to commence imminently

- Canastra Niobium Project, Brazil – In the Alto Paranaíba Igneous Province, which currently accounts for over 97% of global niobium production

Strong Company Fundamentals

Experienced Management Team

BM8 boast a seasoned management team with a track record of success, in addition to serving or having served on the boards of numerous junior ASX-listed companies.

The board and senior leaders are a collective of different professions from geology to business making for a well-balanced company composition, whilst also having held previous roles with some of the largest resource companies globally bringing a plethora of experience.

Board & Senior Leadership Are Favourably Aligned With Shareholders

Since joining the board of BM8, directors have purchased ~$850,000 worth of shares on-market and/or in placements at a significant premium to today’s share price, averaging ~$0.40 per share.

The board also hold just under 3.5M options with an exercise price of $0.50 due for expiry in early 2026.

Board salaries are also very modest, with the Chairmans remuneration package of $100,000 p.a. and Non-Executive Directors remuneration package of $24,000 p.a.

The CEO also has some favourable Performance Rights, which if achieved offers significant upside for shareholders:

- 150,000 – $0.80 VWAP over 20 consecutive days

- 150,000 – $1.00 VWAP over 20 consecutive days

- 175,000 – $1.20 VWAP over 20 consecutive days

Milestone Expiry Date – 27/01/26.

It is clear to us that the board of directors and senior company leaders have genuine incentives to see share price appreciation and are strongly aligned with shareholders.

Supportive Top 20 Register

BM8 maintains a reasonably tight capital structure, with the Top 20 shareholders holding ~50% of the register.

Despite a difficult two-year period, the Top 20 BM8 shareholders have continued to support the company and increased their holdings from a total of 28M ordinary shares held to 46M ordinary shares held. This is exactly what you want to see as an investor.

It is worth noting the number one substantial shareholder, who is the previous BM8 chairman, during this period has also increased their holdings by approximately 4.8M ordinary shares, purchasing on-market and or in placements, spending over ~$2M at an average of $0.27 (by our calculations).

What To Expect In The Short Term

Until the lithium sector shows some signs of reprieve, we think funds would be best spent advancing the highly prospective Bleiberg Project.

Given the 100 years of historical data, we expect the BM8 team will be able to promptly develop prospective drill targets.

BM8 have advised that they are already in discussions with Austrian regulatory bodies to progress works on site.

With these smoke signals, we expect things to really start moving quickly at the Bleiberg Project.

Peer Comparison

With only 3 other ASX listed peers who have exposure to Germanium & Gallium, we believe BM8 provides the best risk to reward thesis.

BM8 boasts a low market cap, $0 EV, $3M in cash, and one the most advanced historical Germanium & Gallium assets globally with proven higher grades.

BM8 also boasts exposure to a wide array of critical minerals including lithium and copper, whilst also having indirect exposure to Iron Ore, Niobium & Ionic Clay Rare Earths through ASX: EQN who are currently planning to commence a drill campaign in a few weeks.

Further, given that there are only 4 listed ASX companies with exposure to Germanium & Gallium, should any sector catalysts eventuate, with only limited options for the market to place their money, money flow will be concentrated offering significant upside.

Whilst it is hard to ascertain a potential ‘reward’ valuation should BM8 have a successful drill campaign or broader market sector catalysts eventuate, we believe BM8 offers significant upside from its current valuation.