Brightstar – Aggressive Growth Strategy Sees BTR Increase Total Resource To ~3.0Moz Au

It was only recently that we were updating the market on Brightstar’s (BTR) major project acquisition (Brightstar Acquires Linden Gold Alliance), which added the robust portfolio from Linden Golds exploration and production assets within the Laverton Hub.

The team at BTR only a few months later have again executed an aggressive acquisition & merger strategy which will see a three-way deal with Alto Metals and Gateway Mining, resulting in another consolidated exploration/development hub and an accelerated timeline towards its goal of becoming WA’s next genuine mid-tier scale developer.

Snap Shot of the Deal

Acquisition of 100% of the fully paid ordinary shares in Alto Metals Limited (ASX:AME) via an Alto scheme of arrangement. Each Alto shareholder will receive 4.0 BTR fully paid ordinary shares for every Alto share held.

Acquisition of 100% of the tenements comprising the Montague Gold Project currently owned by Gateway Mining Limited (ASX:GML). Upfront consideration of $12.0m, comprising $5.0m in cash and $7.0m in Brightstar Shares, and a further $2.0m in potential contingent consideration.

Raising $24 million at a Price of $0.015 with a 0.0% Discount

Not only have management executed a three-way merger & acquisition, the team have managed to raise $24 million ($7 million subject to shareholder approval) at a price of $0.015 with a 0.0% discount to the last closing price.

It cannot be understated how remarkable this is, in such a challenging market, particularly for gold explorers & developers.

Further, the book is fully covered with existing major shareholders who have increased their holdings, high quality gold funds and new institutions, all which speaks volumes to the quality of the proposed company merger & acquisition in addition to the overall prospects of BTR.

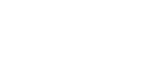

BTR Now Has The Largest WA Gold Based Resource, Outside of De Grey

Outside of De Grey, BTR will now have the largest Mineral Resource of WA-based gold explorers/developers on a fast-track to develop multiple mines across the portfolio in the near term.

The proposed merger & acquisition of Sandstone and Montague East, provides the foundation for a third production hub by adding a further JORC resource of ~1.5Moz @ 1.5g/t Au, doubling BTRs total mineral resource to ~3Moz, which is located near its own and third-party milling infrastructure.

In addition to adding 1.5Moz to BTR’s total resource, of which most is open-pitable, these acquisitions also provide significant resource growth potential, demonstrating continued near surface, high-grade results open along strike and at depth.

| Alto | Gateway |

|

1.5Moz @ 1.5g/t Au of Mineral Resource added

3.0Moz @ 1.5g/t Au Total Resource |

|

| 23.5Mt @ 1.4g/t Au for 1.05Moz | 9.6Mt @ 1.6g/t Au for 0.5Moz |

| 90% of the MRE is within the top 150m | 70% of MRE is within the top 100m |

| Deposits open along strike and at depth | Large component of the current resource is open-pit oxide material |

| 740km2 over the Sandstone Greenstone Belt, WA | 450km2 of tenure in a well-endowed belt, WA |

| Proximal to multi-million-ounce gold deposits and producing mines | 70km NNE of Alto’s Sandstone Gold Project |

| Granted mining leases | The grade and indicative strip ratios indicate strong potential to truck material to a central processing facility in Sandstone |

| Sealed highway to the project | |

| Local airport | |

| Metallurgical recoveries up to 98% | |

Not All Gold Explorers / Developers Are Created Equal

Post acquisition, initially BTR’s market cap and enterprise value appear to be relatively similar to most of its peers, however the companies advantage and clear value is highlighted by its low CAPEX and existing processing plant valued at $60m.

Managements low risk and low-cost approach to production provides BTR a clear advantage to its peers, significantly reducing the funding hurdle required to move into production, which is arguably the most challenging element for explorers & developers.

| Brightstar (ASX:BTR) | Ausgold (ASX:AUC) | Black Cat (ASX:BC8) | Magnetic Resources (MAU) | |

| Market Cap | $151m | $109m | $140m | $411m |

| Enterprise Value | $119m | $87m | $141m | $402m |

| Cash | $31m | $24m | $14m | $9m |

| Debt | $0 | $2m | $15m | $0m |

| Assets | $60m | $0 | $? | $0 |

| Total Resource | ~3Moz @ 1.5g/t | 3Moz @ 1.1g/t | 2.5Moz @2.9g/t | 1.88Moz @ 1.8g/t |

| Development Phase | DFS | DFS | PFS / Scoping | PFS |

| Mine Type | OP | OP | OP | OP |

| Location | Sandstone, Laverton & Menzies, WA | Katanning, WA | Kalgoorlie, Coyote, Paulsens WA | Laverton, WA |

| Notes |

|

|

|

|

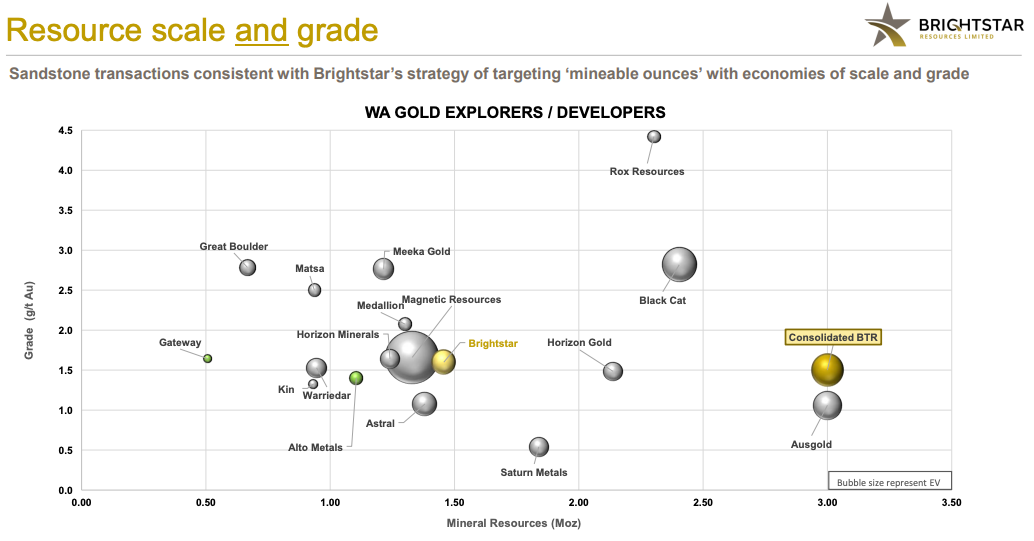

Acquisition Cost of $35/oz Vs $106/oz Sector Average is Accretive for BTR Shareholders

The value proposition of these project acquisitions for BTR and its shareholders can be seen as extremely accretive, demonstrated by the total acquisition cost of $35/oz.

To put into context just how value accretive this is, over the past three years the comparable M&A average for ASX-listed WA pre-production gold assets is $106/oz, which is ~200% higher than what the BTR management team have managed secure their assets for.

This clearly demonstrates to us an astute management team taking advantage of the depressed gold sentiment, despite gold spot prices at record highs. In our opinion this perfectly positions BTR to capitalise on any positive turn in the gold sector and as the company moves into production.

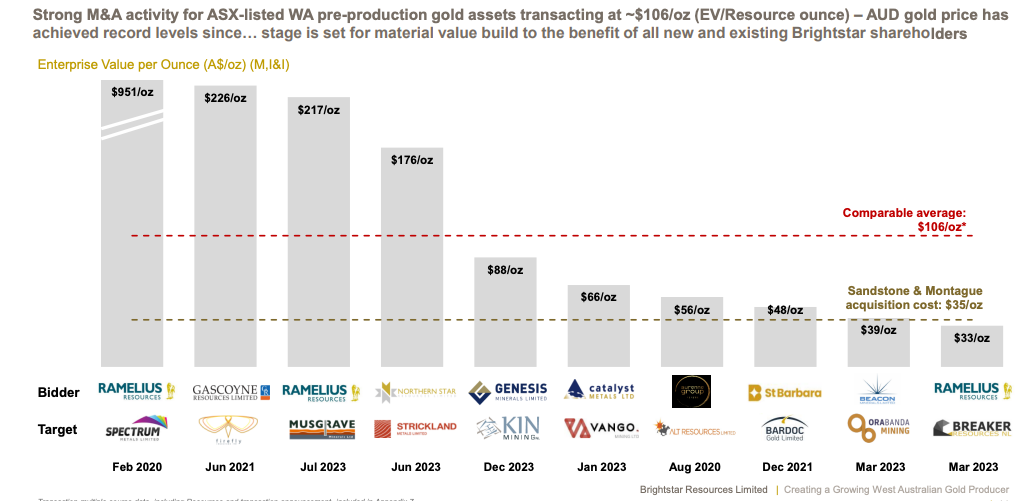

Consolidation of Promising Sandstone District Creating a Potential Third Production Hub

On completion of the acquisition, BTR will have strategically consolidated ~1,100km2 of landholding in the Sandstone region, which has the mineral endowment and exploration upside to become a significant gold development region in WA and BTRs third production hub.

This consolidation highlights BTRs aggressive growth ambitions to become a multi asset mid-tier WA gold producer.

However, it is clear to us that management are not pursuing growth for the sake of growth, as the Sandstone hub provides clear synergies and complements BTRs two existing production hubs, Laverton and Menzies:

- Undervalued assets with mineable ounces in WA

- Deposits are shallow & open-pittable

- Both projects have significant exploration upside

- The geographical location of the individual projects which have been acquired are in close proximity of each other

- Consolidation of multiple assets in close proximity resulting in economies of scale & cost efficiencies to create a new large-scale production hub

- Acquisitions are in close proximity to BTRs existing Laverton & Menzies hubs

- Brightstar intends to use future cash flows from the Menzies and Laverton hubs to largely organically fund the exploration and development of the Sandstone hub

Interestingly, BTR also advised that they would continue to assess logical consolidation in the Sandstone district to continue to unlock value for shareholders.

BTR On a Fast-Track to Develop Multiple Mines Across the Portfolio in the Near Term

BTR are already looking to be in development at Menzies & Laverton in 1H CY2025, and management have advised of their intention to fast track the newly consolidated Sandstone Hub, with a proposed centralised processing plant, fed by shallow, high-grade open pits from within the Montague and Sandstone Projects.

More importantly, BTR boast a proven management team who can execute on this strategy, consisting of experienced mine builders, operators and financing / capital markets, which in turn backs its goal of becoming a significant gold producer within the next four to five years.

“Brightstar, as the owner of the consolidated Sandstone Project post transaction, would seek to fast-track the development timetable through:

- A focused, multi-rig infill drill out to take the inferred mineralisation into Measured & Indicated status to underpin mining studies and project advancement

- The application of Brightstar’s dedicated in-house geological and mining engineering team to retain crucial project IP and fast-tracked mining studies;

- Access to mining equipment and operators through the affiliation with open pit mining contractor Blue Cap Mining (affiliated with BTR Director Ashley Fraser)

A well-funded focused extensional exploration program will also be applied to the broader Sandstone Project to continue to grow the current JORC Mineral Resource base”

200koz P.A Production Target with Non-Dilutive Cash Flow Opportunity

As BTR positions itself as a multi-asset developer with ambitions to be a significant producer in 3 – 4 years, targeting up to 200koz p.a, it offers significant growth potential in shareholder value through operational delivery of substantial production run-rate.

Currently, BTR are developing their DFS for the Menzies and Laverton hubs, which are expected to be development ready in 1H CY2025 with a low risk and low capex start-up to production towards ~100koz p.a.

However, this strategic consolidation of the Sandstone region provides a new district-scale growth platform, necessary to take BTR from ~100kozpa towards a critical mass of ~200kozpa, offering further upside potential.

BTR have already outlined a strategy to pursue non-dilutive funding opportunities, advising when the Menzies and Laverton hubs are in production, it is expected they will assist to expedite and organically fund further investment in the Sandstone and Montague East Gold Projects.

BTR has also executed a non-binding initial offer from AustKor Mineral, which is a South Korean strategic investor with strong connections to precious metals refining and gold distribution market in South Korea for an investment of up to $40 million.

Subject to binding documentation, the completion of the company’s consolidated DFS and a final investment decision, the offtake funds will be used to refurbish its existing processing plant in Laverton, delivering on management’s plan for a low capex approach to production.

Clear Value Creation Pathway

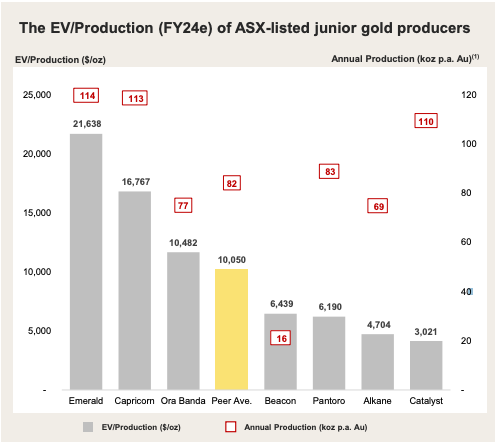

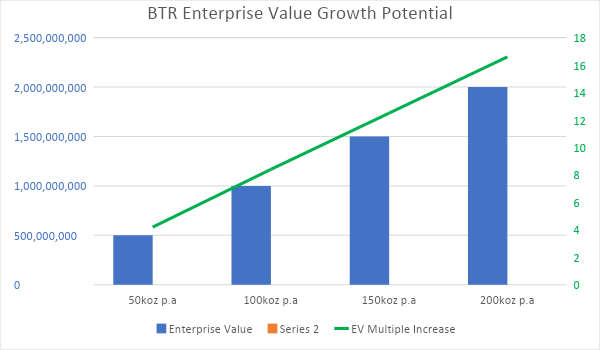

As shown in the below EV/Production graph (figure 1) ASX gold produces (taken from ASX listed peers producing less then ~150kozpa) trade at an average of $10,050 per production ounce. What does this actually mean? Well, if you apply that peer average EV per production ounce, we can ascertain the potential upside value for BTR (refer Figure 2) as they transition from developer to producer and grow their production capacity.

Figure 1 – EV/Production of ASX-listed junior gold producers

Figure 2 – BTR EV Growth Potential

Near Term Share Price Catalysts

- On-going exploration results from the Company’s 30,000m drilling program across the existing Menzies and Laverton assets

- Completion of an integrated Development Feasibility Study (DFS) at Menzies & Laverton

- Deliver on the mine plan that will be outlined in the consolidated DFS, targeting up to 100koz p.a

- 50,000m RC and DD infill and extensional drilling campaign at Sandstone

- Increase global resources & delineate new targets.

Company Risks

As BTR ramp up their production and feasibility studies, the company will be subject to new risks as noted below:

- Funding / dilution – BTR is reliant on additional funding to secure pre-production CAPEX and complete full mine commissioning should they opt to use their existing processing plant. It is not yet clear what form this funding will take, and there is no guarantee that funding will be achieved.

- Project delays and cost overruns – Pending feasibility studies, BTR’s ability to develop and potentially commercialise their Project on schedule may be affected by factors including project delays and cost overruns.

- Lower than forecast commodity price (A$) – A prolonged suppression of the gold price or a substantial strengthening of the Australian dollar has the potential to reduce the Project NPV.

- Market sentiment – Whilst the gold spot price has recently been at record highs, market sentiment for gold explorers & developers has remain subdued. There is no timeline or indication on when they may change