Fortuna Metals: A Tier-One Rutile-Graphite Opportunity in Malawi

Fortuna Metals Limited (ASX: FUN) is an Australian critical minerals company focused on the discovery and development of rutile and graphite deposits in Malawi. The company holds a strategic land package of 658 km², directly adjoining Sovereign Metals’ (ASX: SVM) Kasiya deposit, which represents the world’s largest rutile resource and the second-largest flake graphite deposit. Fortuna’s strategy is to leverage this Tier-One geological setting to aim of discovering high grade rutile needed to fill looming structural deficit and unprecedented demand for titanium metal used in robotics, aerospace and advanced manufacturing.

Recent Updates:

- Acquisition of Ice Shelf Resources – 10 September 2025: Fortuna entered a binding agreement to acquire Ice Shelf Resources Pty Ltd, securing 100% ownership of the Mkanda & Kampini rutile-graphite projects in Malawi. The consideration includes ~55 million ordinary shares, performance shares, a cash payment of A$100,000, and a 1.5% gross revenue royalty.

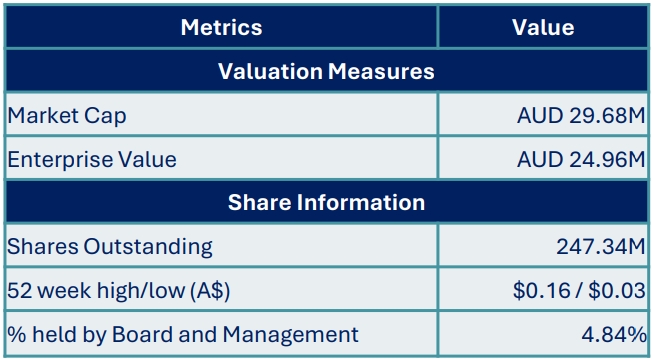

- Capital Position & Name Change – 20 August 2025: Fortuna Metals Ltd, formerly Lanthanein Resources Ltd, began trading under its new name and ticker FUN. A full share-consolidation was completed, and the company is fully funded with A$4.718M cash as of 8 September 2025.

- Strategic Benchmark – Sovereign Metals (ASX: SVM): Sovereign Metals’ Kasiya deposit provides a critical benchmark for understanding rutile-graphite potential in Malawi. With a resource of 1.8Bt @ 1% rutile and 1.4% TGC, confirmed by a Definitive Feasibility Study, Kasiya has already attracted major global partners including Rio Tinto, Mitsui, Chemours, and Hascor. Fortuna’s projects lie directly adjacent to and along strike from this Tier-One deposit, sharing the same geological rutile and graphite bearing rock type which hosts Kasiya deposit.

- CEO Appointment – Tom Langley: Mr Thomas Langley was recently appointed as Chief Executive Officer. He holds a BSc in Geology from the University of Western Australia and a MSc in Economic Geology from the University of Tasmania (CODES), and has worked with groups such as BHP Nickel West, Northern Star Resources, and Creasy Group.

- Performance Incentive Milestones: Key targets include:

- Delivering multiple high-grade drilling intersections by September 2026.

- Defining a JORC-compliant resource of at least 100Mt by September 2027.

- Completing a feasibility study with a post-tax NPV above A$500m by September 2028.

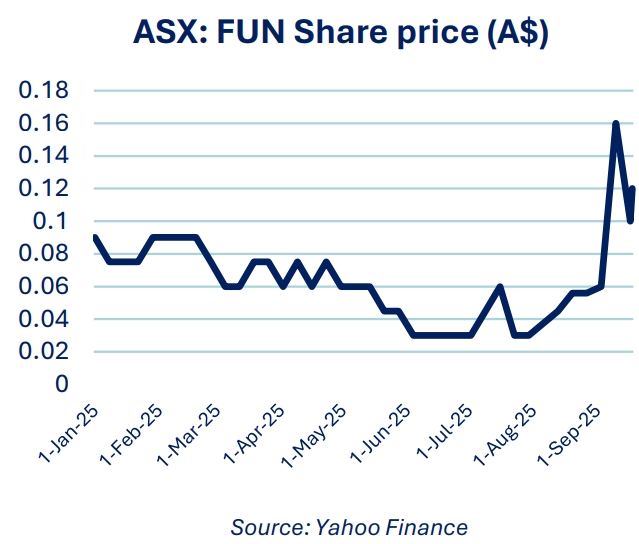

- Achieving share price VWAP milestones of A$0.075 (2026), A$0.15 (2027), and A$0.25 (2028).

Share Price: 0.12

ASX: FUN

Sector: Basic Minerals

18 September 2025