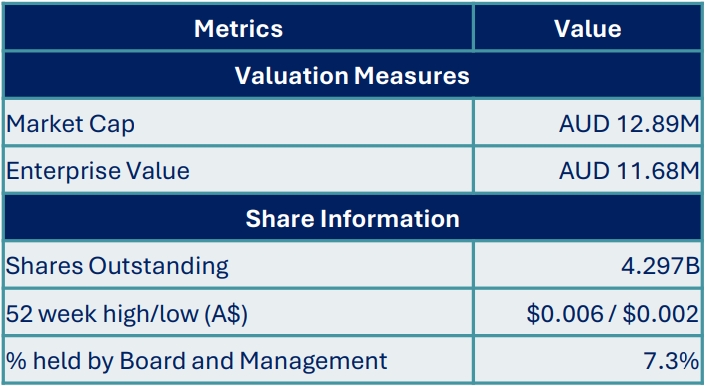

Altair Minerals Limited (ASX: ALR) is an Australian mineral exploration company focused on investing in the resource sector through direct tenement acquisition, joint ventures, farm-in arrangements, and new project generation. The company’s primary projects include Olympic Domain, Wee Macgregor, and Venatica Copper Project.

Recent Updates:

Global Copper : Market Analysis 2024

The global copper market has established itself as a pivotal component within the global economic landscape. In 2023, the market size was valued at USD 318.19 billion, projected to reach USD 333.15 billion in 2024, and expected to grow significantly to around USD 548.20 billion by 2034. This growth, marked by a compound annual growth rate (CAGR) of 5.11% from 2024 to 2034, underscores the increasing demand for copper across various industries such as electronics, construction, and transportation. Copper’s indispensable role in technological advancements, including electric vehicles, telecommunications, and renewable energy solutions, continues to drive its prominence.

Global Copper Market Size – USD Billion

Copper Market Share – By region 2023

In 2023, the copper market was dominated by the Asia Pacific region, which accounted for 39% of the total market share, followed by North America with 30% and Europe with 24%. Latin America held a smaller share at 4%, while the Middle East and Africa contributed 3% to the global copper market.

In 2023, the Asia Pacific copper market was valued at USD 124.09 billion and is projected to exceed USD 213.80 billion by 2034, with a compound annual growth rate (CAGR) of 5.30% from 2024 to 2034.

North America is expected to experience the fastest growth in the copper market. The region holds a substantial market share due to strong demand across various sectors such as construction, electronics, automotive, and renewable energy. Its well-developed industrial base and ongoing infrastructure advancements further drive the high consumption of copper.

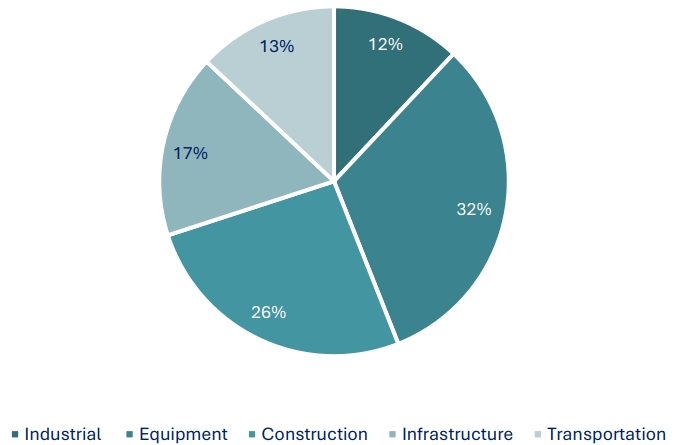

Distribution of copper consumption worldwide in 2023, by end use

The distribution of global copper consumption by end use was led by the equipment sector, which accounted for 32% of total usage. The construction industry followed with 26%, while infrastructure contributed 17%. Transportation and industrial applications made up 13% and 12%, respectively. Equipment represented the largest share of copper semis (copper and copper alloy production), showcasing its significant role in global copper consumption.

Copper Demand and Outlook for 2025

In recent years, global demand for copper has experienced consistent growth due to increasing urbanisation, electrification, and the global energy transition. In 2023, total copper demand stood at approximately 31 million tonnes, with 22 million tonnes sourced from primary production, 6 million tonnes from direct scrap, and 4 million tonnes from secondary sources. By 2025, demand is expected to rise further, driven by sustained growth in traditional applications and emerging sectors.

Key Drivers of Copper Demand Growth

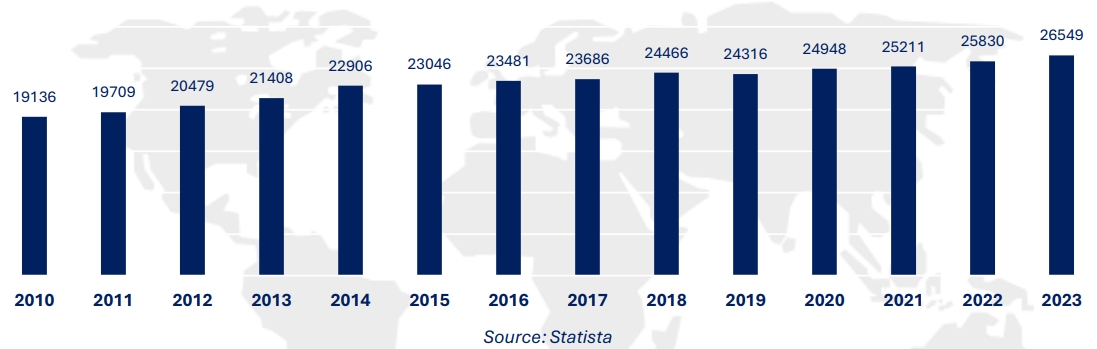

Refined copper usage worldwide from 2010 to 2023 (in 1,000 metric tons)

Projected Demand Growth by 2025

By 2025, copper demand is expected to continue its upward trajectory, supported by growth in traditional applications and emerging sectors such as renewable energy, electric vehicles (EVs), and smart technologies. Analysts predict a compound annual growth rate (CAGR) of 2.6% leading up to 2035, marking a rebound from the slower growth of 1.9% CAGR observed in the 15 years prior to 2021.

Copper Supply and Outlook for 2025

Current Supply Landscape

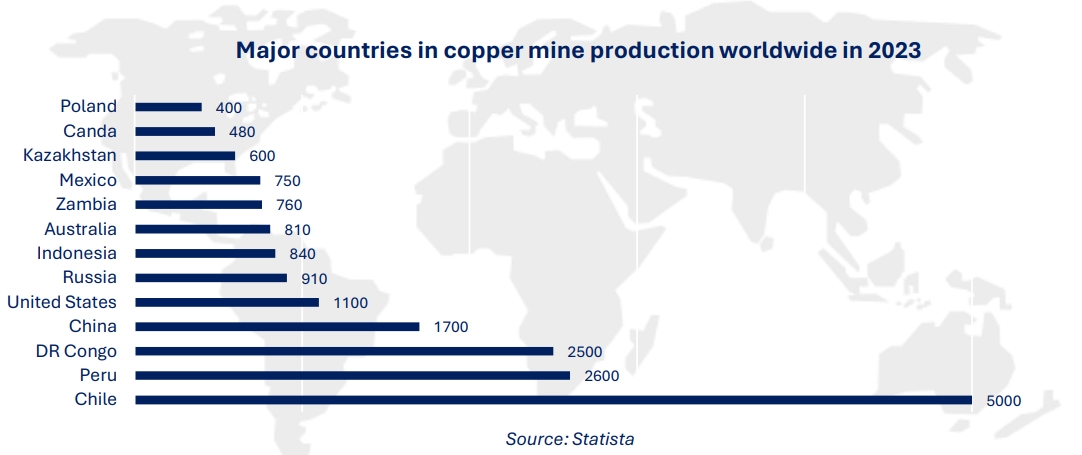

As of 2024, the global copper supply shows signs of moderate growth, with refined copper production expected to increase by approximately 1.1% in 2025. The Democratic Republic of Congo (DRC) and Chile remain pivotal to this growth, collectively contributing a substantial portion of global copper output. In 2023 alone, Chile produced 5 million metric tons of copper, while the DRC followed closely with 2.5 million metric tons. Global smelter production of copper reached a record high of 26.5 million metric tons in 2023, an impressive 4.9% increase from the previous year.

Major Copper Producers in 2023

Copper production remains concentrated in a few countries. In 2023, Chile led the world with 5 million metric tons of production, followed by Peru at 2.6 million metric tons and the DRC at 2.5 million metric tons. Chile’s Escondida mine, the largest globally, had a production capacity of 1.5 million metric tons in 2022, nearly double that of the second-largest mine in Indonesia.

Factors Influencing Copper Supply

Mining Capacity and Production Growth: Expansions in mining capacity are set to bolster copper supply. In 2024, nearly 500,000 metric tons of new capacity was approved for development, signaling robust production activity. Global mine production, which stood at 22 million metric tons in 2023, is forecasted to grow by 2.5% in 2025 due to improvements in mining efficiencies and the completion of new projects. However, challenges such as declining ore grades from aging infrastructure—over 50% of existing mines are more than 21 years old—could offset some of these gains.

Geopolitical and Environmental Challenges: Geopolitical instability and environmental regulations continue to pose risks to copper production. For example, legal and environmental issues recently forced First Quantum Minerals to halt operations at the Cobre Panamá mine. Such disruptions underscore the vulnerabilities in copper supply chains, which may impact market stability in 2025.

Recycling Contributions: Recycling is increasingly significant in copper supply, with approximately 10 million metric tons currently sourced from scrap metal annually. As the industry prioritises sustainable practices, this figure is expected to rise, reducing the reliance on primary production and supporting global supply.

Global Supply-Demand Balance

Phoenix Global Investment 6 Altair Minerals The supply-demand dynamics for copper in 2025 suggest a tightening market. Despite an anticipated increase in global copper production, demand is expected to outpace supply, leading to a forecasted shortfall in copper concentrate of approximately 848,000 metric tons. This imbalance highlights a growing strain on copper resources driven by burgeoning demand in key sectors such as renewable energy and electric vehicles (EVs).

China, traditionally the largest consumer of copper, is projected to see modest demand growth of 1.6% in 2025, reflecting a slowdown in the construction sector. However, other regions are likely to experience more robust growth in copper consumption, particularly due to electrification initiatives and investments in sustainable technologies.

Recycling efforts continue to play a significant role in mitigating the supply gap. Refined secondary copper production reached 4.15 million metric tons in 2022 and is expected to increase as industries emphasize sustainability and circular economies.

Price Outlook

The tightening supply-demand balance is expected to exert significant upward pressure on copper prices. Several factors are likely to drive this trend:

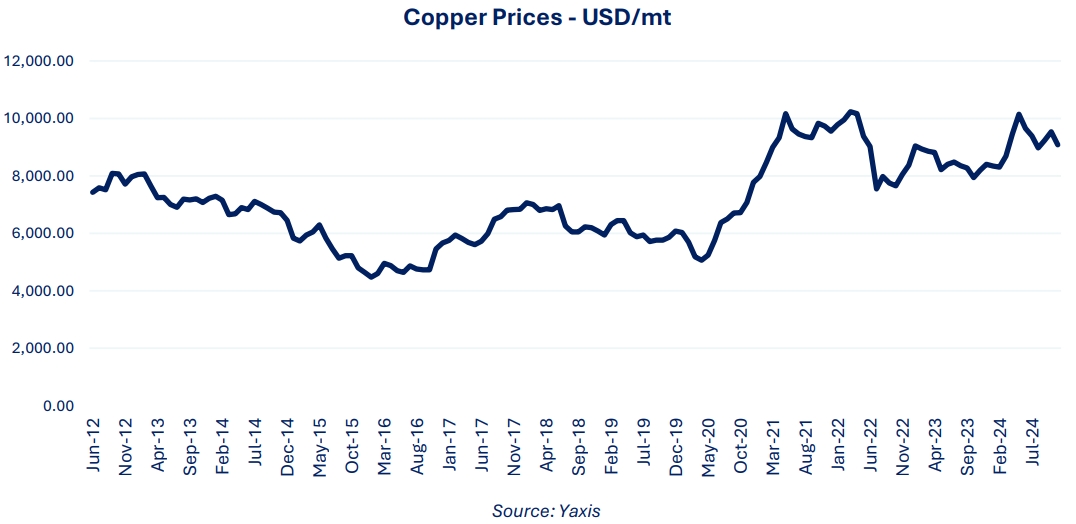

Historical Price Trends and Implications

Copper prices have shown variability over the past decade, influenced by economic cycles and shifts in industrial demand. Prices reached a peak of $9,317 per metric ton in 2021 before declining to $8,490 in 2023. Despite recent fluctuations, the longterm trajectory points to rising prices due to the persistent demand for copper in green technologies and industrial applications

About: Altair Minerals Limited

Overview

Altair Minerals Limited (ASX: ALR) is an Australian mining exploration company dedicated to discovering and developing natural resources, including copper, gypsum, lithium, and cobalt. Below is an updated overview of the company, its key projects, and recent developments.

Key Projects

Olympic Domain Project

Venatica Project

Investment Opportunity: The Venatica Project

Executive Summary

The Venatica Project, owned by Altair Minerals, is a porphyry-skarn copper-gold system located in the Andahuaylas-Yauri Porphyry Belt of southern Peru. The project spans 337 km² of exploration permits and applications, situated 7 kilometers from Abancay, the capital of the Apurímac Region. It benefits from paved roads, electricity, water, and telecommunications, ensuring cost-effective exploration and development.

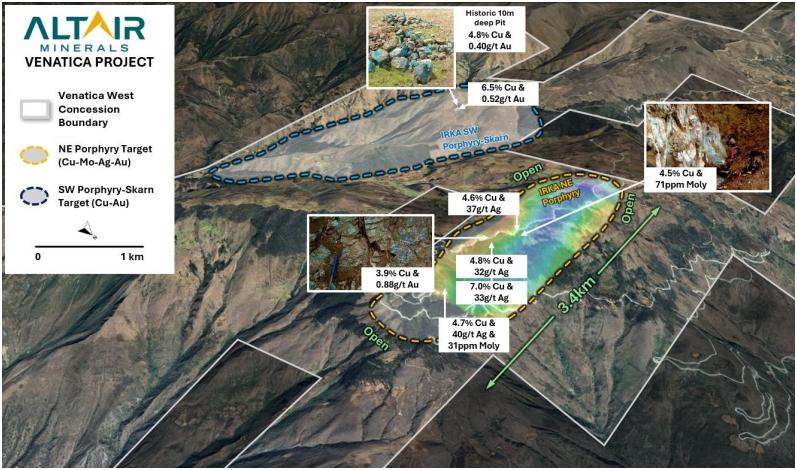

Within Venatica, the most advanced area is Venatica West, where Altair Minerals holds an 80% earn-in option. This region contains

two key copper-gold targets:

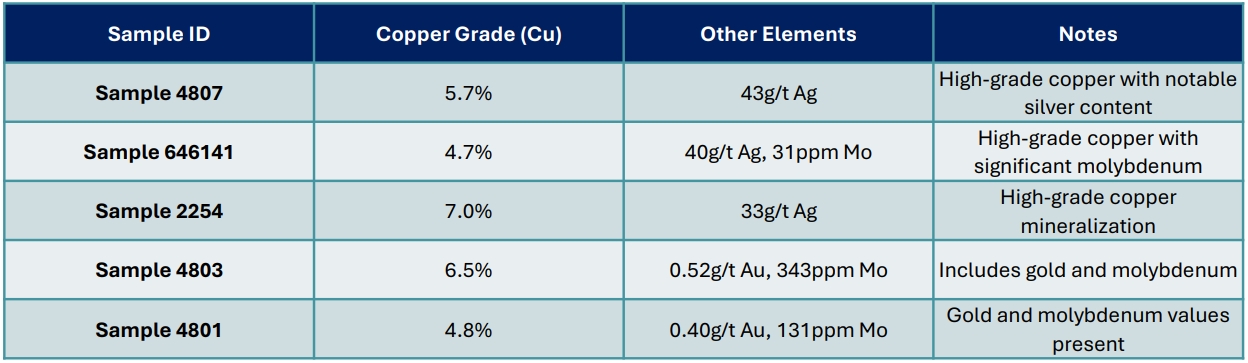

- Irka NE Porphyry (>4 km²) – A high-grade copper-silver-molybdenum porphyry with a 3.4 km strike, showing copper values from 3,000 ppm to >60,000 ppm.

- Irka SW Porphyry-Skarn (>6 km²) – A copper-gold system with extensive mineralization in breccia-hosted zones.

Together, these areas reinforce Venatica’s potential for uncovering large-scale copper-gold deposits in one of the world’s leading porphyry copper belts. With advanced exploration status and active mining licenses, Altair Minerals is well-positioned for immediate operations, making Venatica a high-value investment opportunity on the ASX.

Overview of the Venatica

Project Strategic Location and Infrastructure

The Venatica Project is located within the Andahuaylas-Yauri Porphyry Belt, a region known for world-class copper-gold deposits. This belt has contributed to Peru’s standing as the world’s second-largest copper producer. Venatica’s proximity to Abancay (10 km) provides logistical advantages, reducing exploration and drilling costs to as low as USD $80/m. The project benefits from access to a skilled workforce, dependable utilities, and telecommunications, ensuring efficient exploration and permitting processes.

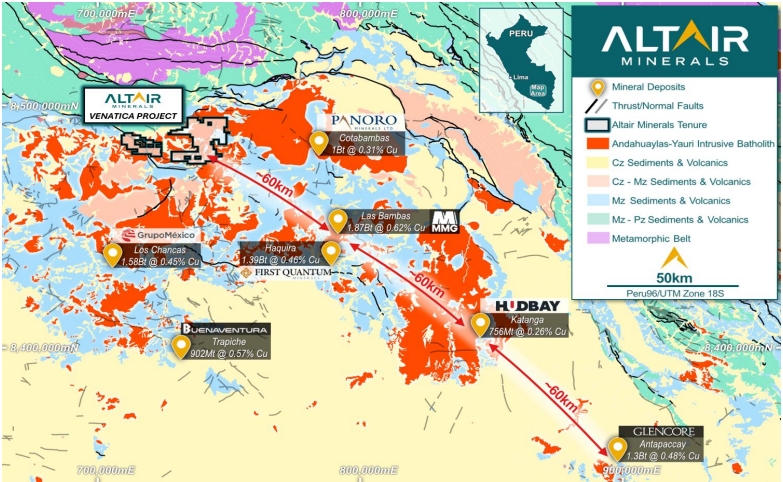

Regional Map of Venatica project situated on Las-Bambas Trend which hosts equidistant Copper discoveries every 60km, multiple >1Bt discoveries sitting on the margin of the Andahuaylas-Yauri Batholith.

Geological Potential

Porphyry-Skarn Systems

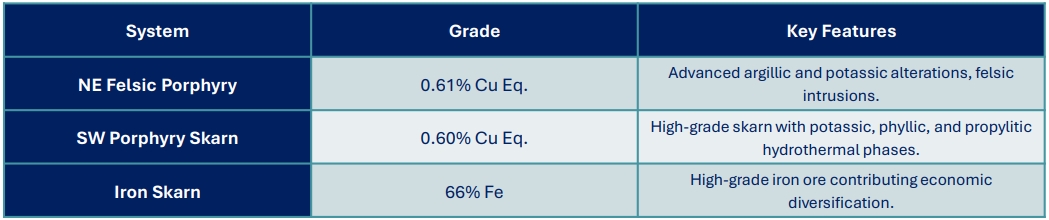

IRKA showcases exceptional geological characteristics, hosting two major mineralisation systems:

The clustering of these systems within a single concession highlights IRKA’s potential as a large-scale, multi-deposit operation.

Structural Controls

Situated at the intersection of two major fault systems, IRKA benefits from:

- Limatambo Fault (NE): Provides extensional structures conducive to mineralisation.

- Apurímac Fault (NW): Channels hydrothermal fluids through a transpressive system.

This unique structural configuration creates ideal conditions for magmatic and hydrothermal activity, resulting in large-scale mineral deposits.

Satellite perspective view of Venatica West with rock samples and Total Field Magnetics overlay and highlighted samples. Note: Due to image being perspective view, the scale provided is only applicable on the SE – NW direction on X-axis. Perspective view skews the true distances as the image moves out of frame (appearing far smaller on the image)

Strategic Positioning

- Venatica covers 337km² along the northern extension of the Las Bambas trend.

- Located within the Andahuaylas-Yauri Batholith, sharing geological and structural controls with nearby Tier-1 deposits, such as Las Bambas.

- Unexplored Northern Extension: Venatica occupies untested areas of the batholith margin, analogous to existing billiontonne deposits.

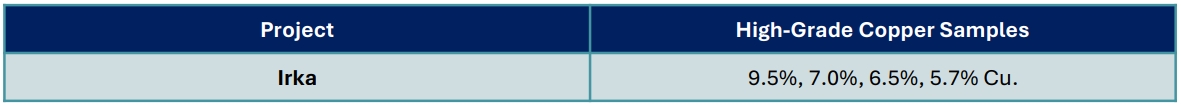

- Surface Sampling Results:

* 9.5%, 7.0%, 6.5%, and 5.7% Cu from porphyry dykes.

* Up to 4.59g/t Au, 160g/t Ag, and 471ppm Mo credits.

* Large lateral copper mineralized footprint (~6km²), with vertical potential untested.

Geological Insights

The project is located in a highly prospective geological belt that hosts several large copper deposits, including those that have >1 billion tons of resources. The mineralization types targeted in Venatica are:

- Porphyry and Skarn: These are the main mineralization types, contributing to the project’s potential for large-scale copper extraction.

- Notable Sampling Results: High copper grades of up to 9.5%, with additional elements such as molybdenum (Mo), silver (Ag), and gold (Au), suggest significant potential for resource extraction.

Sampling and Historical Mining Insights

- Surface Sampling: Results from extensive surface sampling include copper grades as high as 7% Cu with significant silver, gold, and molybdenum values. These indicate high-grade mineralization at or near the surface.

- Small-Scale Mining History: Previous small-scale mining operations have yielded copper grades of up to 6%, particularly

from porphyry and skarn target

Historic shaft on Skarn Target which sampled – 6.5% Cu & 0.52g/t Au

Large Felsic Porphyry Exposure with mineralised Breccia which sampled – 4.5% Cu & 71ppm Mo and 4.6% Cu & 37g/t Ag

Competitive Advantage

Proximity to Major Copper Deposits

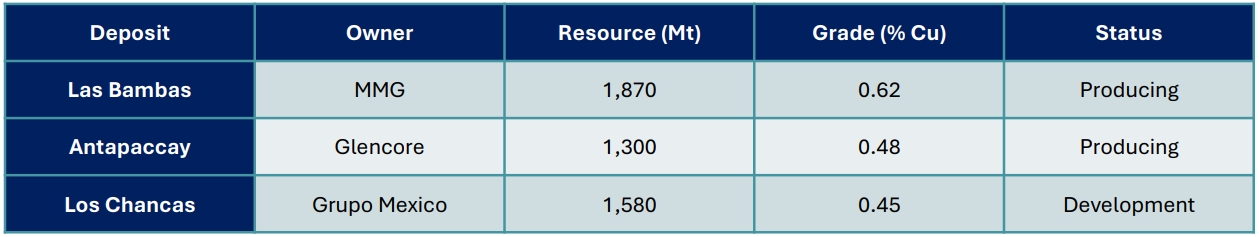

Both IRKA and Venatica are strategically located near some of the world’s most significant copper mines, including:

These neighboring projects validate the geological fertility of the Andahuaylas-Yauri Belt and ensure shared infrastructure benefits for IRKA and Venatica.

Grade Superiority

Surface sampling and small-scale mining confirm its status as a high-grade exploration target with Tier-1 potential. The SW Porphyry Skarn boasts an impressive 1.60% Cu Eq., significantly outperforming many regional deposits. This high grade enhances IRKA’s economic appeal, particularly in a market increasingly focused on resource quality. Operational Efficiency.

Operational Efficiency

- Low-Cost Drilling: Estimated at USD $80/m, leveraging proximity to Abancay.

- Active Licenses: No permitting delays enable immediate exploration and development.

Demand Outlook

The International Energy Agency (IEA) projects a robust surge in global copper demand, driven by pivotal trends in electrification across industries and rapid urbanization in emerging economies. The transition to renewable energy systems, coupled with the proliferation of electric vehicles, underpins the essential role of copper as a cornerstone metal for modern infrastructure and green technologies. The IRKA project, with its substantial scale and exceptionally high-grade copper resources, is strategically positioned to capitalize on these burgeoning market dynamics, delivering a unique opportunity for stakeholders to engage with a project at the nexus of innovation and industrial transformation.

Exploration and Development Readiness

Work Completed to Date

- Extensive Mapping and Sampling:

* Over 150 samples collected and analyzed, which validate the presence of widespread high-grade copper mineralization across the project area.

* Sample results exhibit concentrations significantly above industry averages, indicating the potential for a world-class deposit. - Comprehensive Geophysical Studies:

* A suite of magnetic, gravity, and spectrometric surveys has been conducted, revealing extensive zones of mineralization.

* These studies have successfully delineated key structural controls and prospective targets, enhancing the understanding of subsurface geology. - Historical Drilling Achievements:

* Previous drilling campaigns conducted by Panoro unearthed promising mineralized zones within the NE Felsic Porphyry.

* Results highlight a clear pathway for follow-up drilling to expand on existing knowledge and identify additional high-grade zones.

Next Steps

Resource Expansion:

- Focused Drilling Campaigns:

* A systematic drilling program is planned to refine and expand the known resource base.

* Emphasis will be placed on delineating both shallow, high-grade zones and deeper extensions, ensuring a comprehensive understanding of the deposit’s scale and quality. - Advanced Geochemical and Geophysical Surveys:

*New technologies will be deployed to enhance exploration accuracy, particularly in underexplored areas of the project.

Pre-Feasibility Studies:

- Economic Viability Assessment:

* A detailed evaluation of mining methods will be conducted to identify the most cost-effective and sustainable extraction techniques.

* Advanced economic modeling will be employed to ensure optimal project returns while aligning with global ESG standards. - Infrastructure and Logistics Planning:

*Studies will address critical infrastructure needs, including transportation, water management, and energy supply, to facilitate seamless project execution.

Strategic Advantages

- With its advanced exploration status, IRKA is primed for immediate transition to development, bypassing many of the time-consuming hurdles associated with greenfield projects.

- The project’s high-grade resources and scalability offer a compelling investment case, promising accelerated returns and resilience against market fluctuations.

This meticulous approach ensures that the IRKA project not only meets but exceeds the expectations of investors, stakeholders, and regulatory bodies, positioning it as a frontrunner in the next generation of global copper mining ventures

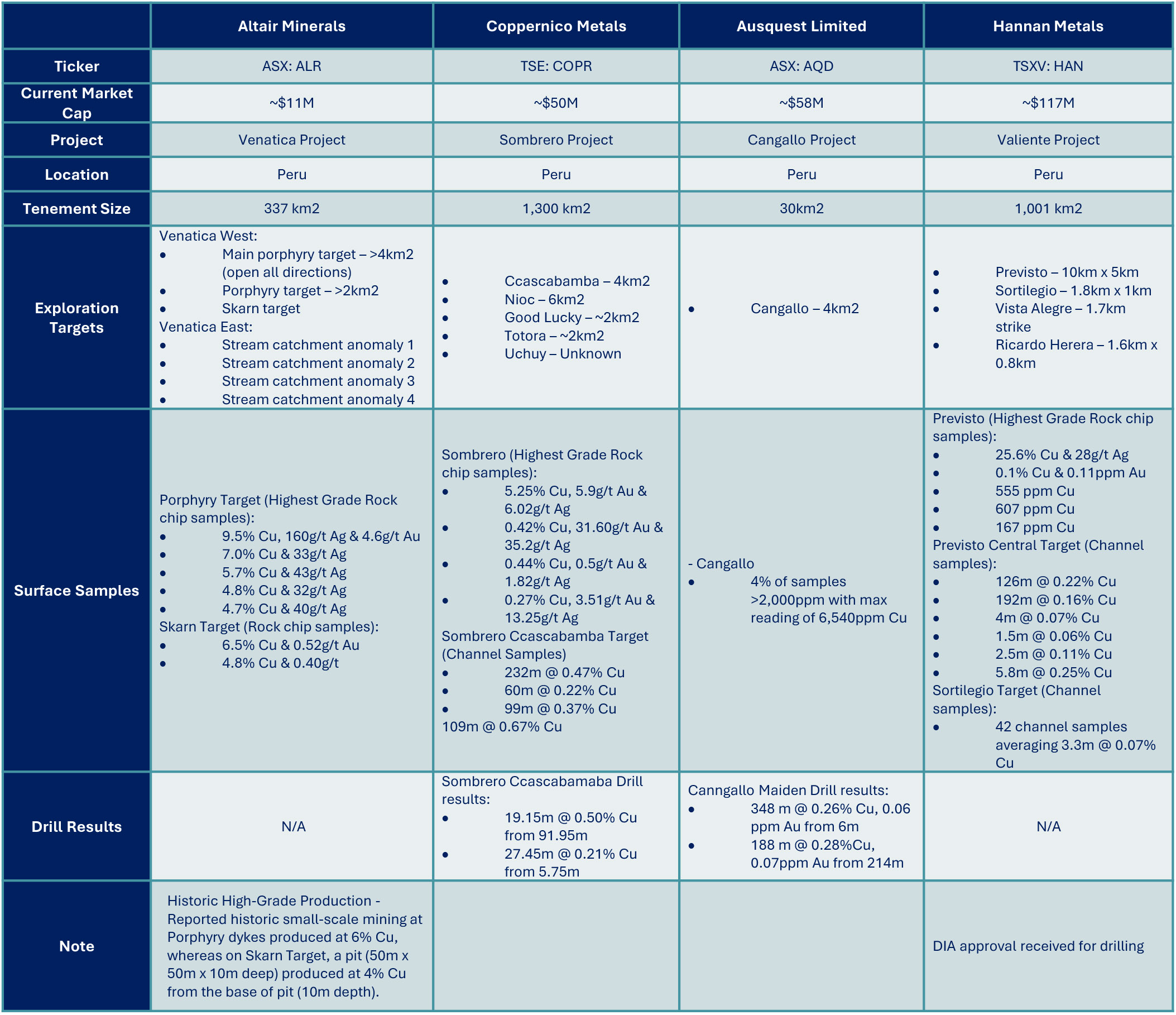

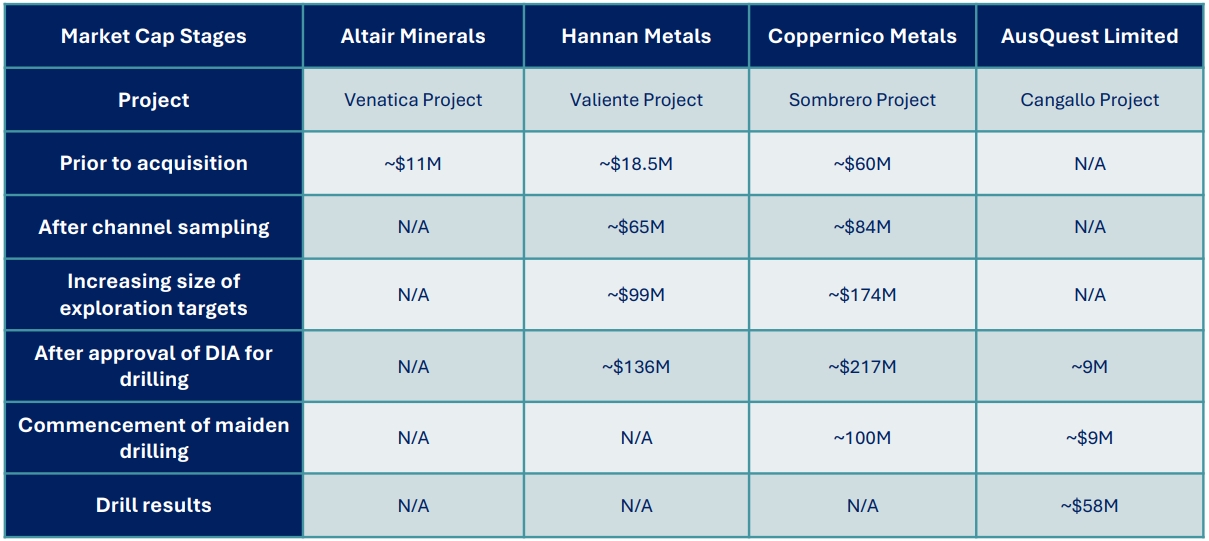

Venatica Copper Project Peer Comparison

Following ALR’s acquisition of Venatica, the primary question is: what is the potential upside?

Our analysis identified three junior explorers that have recently achieved success with their copper-gold projects which are also located in Peru, which have led to significant increases in company valuations.

The only comparable ASX listed peer is Ausquest Limited (ASX: AQD), whose flagship Cangallo Porphyry Copper Project recently revealed a major porphyry copper-gold discovery. This news has driven a remarkable ~450% rise in their share price within just a few weeks.

Hannan Metals (TSXV: HAN), is a Peruvian exploration company whose Valiente Project shares many parallels with ALR’s recent acquisition and has delivered outstanding performance for shareholders over the past 12 months with their exploration success.

Coppernico Metals (TSE: COPR) also provides support to ALR and its potential, noting the company had significant support over the past few years at their Sombrero Project, holding significant valuations, despite not undertaken any drilling until recent.

Peer Valuation Stages

Note – Market Capitalisation calculated in Aud

Peer Comparison

Analysis Over the past few years, AusQuest Limited (AQD) has struggled to deliver substantial returns for shareholders despite maintaining exploration activity across multiple projects. Therefore, it is difficult to draw a clear path of valuation accretion, as it was only announced December 2024, that AQD would now be focusing on the Cangallo Porphyry Copper Project and commence a maiden drilling campaign.

Nonetheless, AQD have clearly demonstrated value uplift from their successful maiden drilling campaign at Cangallo, which saw their market cap rise from ~$9M to a peak of ~$60M, which is almost a 7 x increase of their market value in a matter of days. This underscores the market’s strong response to exploration success in the region, and clearly highlights the prospectivity of ALRs acquisition.

Comparatively, ALR’s Venatica project is significantly larger (ten times the size of AQD’s Cangallo) while also hosting multiple, more extensive exploration targets with a wealth of coincidental surface expression anomalies.

AQD’s highest-grade rock chip sample reported a maximum 6,540 ppm Cu in addition to 4% of total samples exceeding 2,000 ppm Cu. In contrast, Venatica has a reported peak grade of 69,500 ppm Cu, with 20% of all samples surpassing 3,000 ppm Cu. This suggests a more extensive and concentrated mineralized system at Venatica, potentially positioning it ahead of Cangallo at their pre-discovery stage.

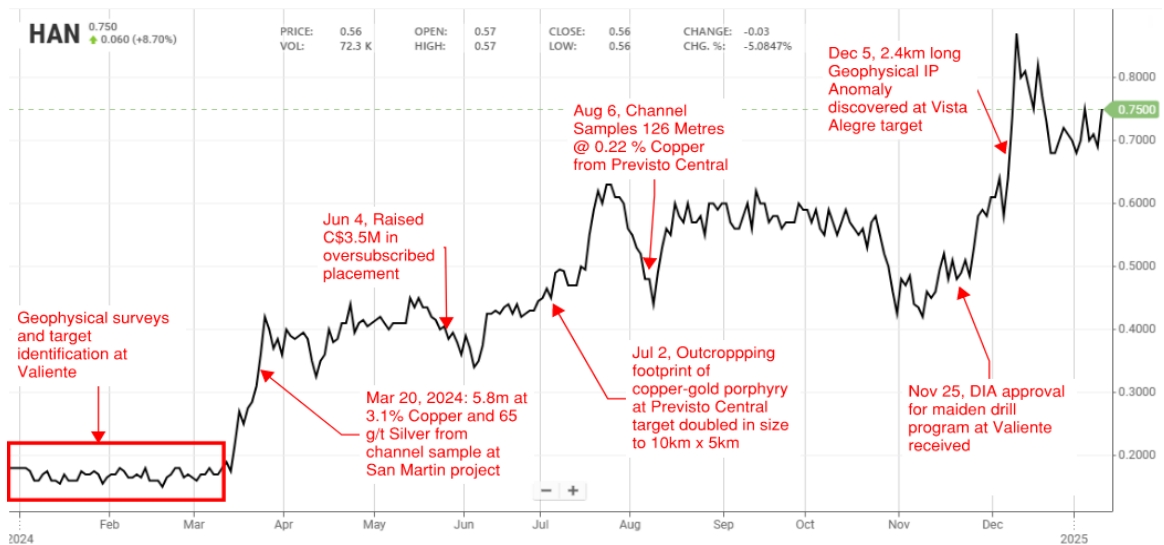

Looking abroad, as of writing this, Hannan Metals Limited (HAN) has a market cap of approximately AUD 117M, a remarkable increase from March 2024, when the company had a modest market cap of around AUD 18M.

HAN’s valuation is particularly notable given that the company has not yet undertaken a single drill hole. We attribute this significant valuation to two key factors:

- The highly prospective region in which their project is located.

- The size and scale of the identified exploration targets.

Peru is the world’s second-largest copper producer and is home to some of the most prolific copper belts globally. These belts are renowned for hosting massive porphyry & skarn copper deposits, which, while not necessarily high-grade, are characterized by their vast scale.

Although HAN has not initiated drilling, the company has defined several large porphyry copper targets through geophysical surveys and surface sampling. The market is evidently ascribing significant value to the potential of these large footprints, with the expectation that they could yield a large, low-grade copper deposit.

In comparison, ALR currently has a market cap of approximately AUD 11M, drawing parallels to HAN’s valuation before its channel sampling and surface work programs. However, the Venatica Copper Project already boasts a substantial amount of rock chip sampling and well-defined exploration targets, adding confidence to our investment thesis.

Coppernico Metals (COP) has followed a similar valuation trajectory to HAN. However, unlike HAN, COP has been advancing its Sombrero project since 2016, which may not provide as clear a pathway to share price growth in comparison. Despite this, COP’s valuation increased approximately 350%, reaching a peak market capitalization of ~$250M, without undertaking any drilling on its project. This elevated valuation may have been supported, in part, by several historical drill holes from previous project owners.

We believe that if ALR demonstrates significant scale and/or grade through future exploration campaigns, the company’s share price is likely to experience a substantial re-rating.

For instance, should ALR achieve exploration success following its surface sampling program, with results comparable to HAN’s, we could see ALR’s valuation increase by approximately 500%. At a similar stage of exploration, HAN’s market cap was AUD 65M, providing a potential benchmark for ALR’s growth trajectory.

Hannan Metals Pathway of Results & Share Price Growth over Past 12 months

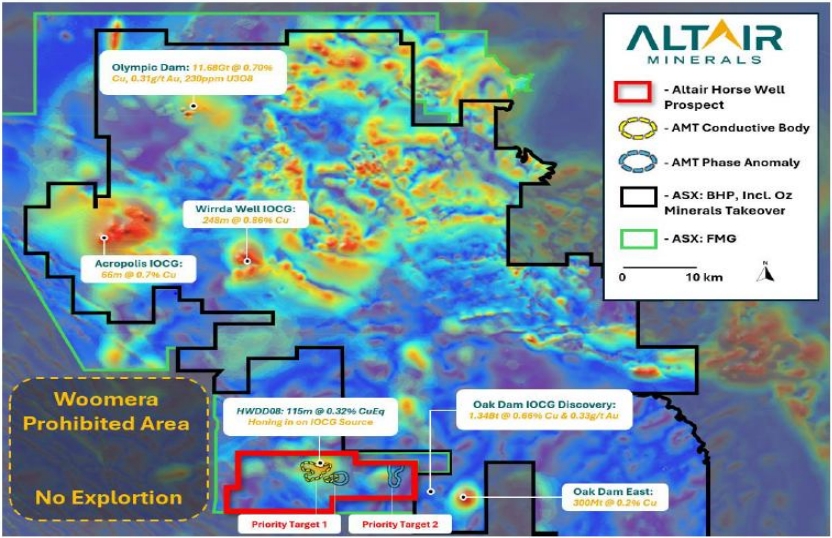

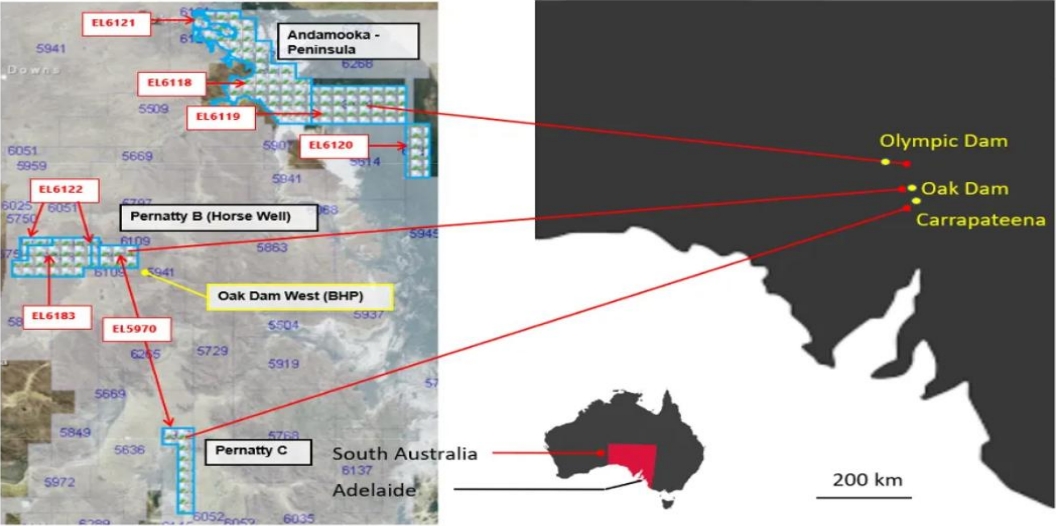

Olympic Domain Project

Olympic Domain project in South Australia’s Gawler Craton—one of the world’s premier IOCG (Iron Oxide Copper Gold) systems. This strategic location, advanced exploration techniques, and high-priority drill targets position Altair as a promising junior miner with significant upside potential.

Strategic Location

- Gawler Craton: A globally recognized copper province hosting world-class IOCG deposits like Olympic Dam, Carrapateena, and Oak Dam.

- Proximity to Major Discoveries: Altair’s key prospects are situated within ~5 km of BHP’s Oak Dam, which spans 1.6 km and boasts 1.34Bt @ 0.66% Cu and 0.33g/t Au.

Significant Resource Potential

- Large Tenement Holdings: Altair holds 831 km² across three key prospects (Horse Well, Pernatty C, and Lake Torrens).

- Early Impressive Drilling Results:

• 115m @ 0.62% CuEq from 1095m (Horse Well Fault).

• 70m @ 0.67% CuEq from 962m (Bluebush Fault). - Comparable Systems: Geophysical anomalies and assay results align with globally significant IOCG systems like Olympic Dam and Carrapateena.

Horse Well Total Magnetic Intensity (TMI) overlaid with TMI variable reduction to pole (VRTP) 2nd derivative – SARIG. Shown are two of

Altair’s key high-priority magnetic targets.

Game-Changing IOCG Discovery Opportunity

Recent advanced AMT data analysis has uncovered coinciding conductive and phase anomalies that remain untested, representing a fresh and unprecedented exploration opportunity near the globally renowned BHP Oak Dam deposit.

Strategic Location & Comparable Potential

- Priority Drill Targets located ~5km Northwest of BHP Oak Dam Deposit, which hosts 1.34Bt @ 0.66% Cu & 0.33g/t Au, spanning 1.6km N-S strike.

Forward AMT Model Plan View for Phase Anomalies at 4.06Hz frequency, with two major conductive targets. Model generated by Adelaide Mining Geophysics Pty Ltd.

Exceptional Target Potential

Major targets identified with potential for globally significant discovery

- A large conductive target spanning 4.2km N-S strike, indicating substantial mineralization.

- A distinct ovoid conductor extending 1.9km E-W strike, showcasing geological parallels with world-class IOCG deposits like

Carrapateena and Khamsin.

Breakthrough Insights Through Advanced Expertise

Critically, these targets emerged from innovative geophysical expertise and proprietary analysis, overcoming limitations of

previous exploration efforts that failed to recognize this potential.

Previous drilling focused on the outer mineralized halo of AMT highs, with standout intersections including:

- 115m @ 0.32% CuEq

- 61m @ 0.33% CuEq

- 115m @ 0.62% CuEq

- 70m @ 0.67% CuEq

These results suggest a major untapped potential in the mineralized core, awaiting further drilling.

Project Highlights by Prospect

Horse Well (Pernatty B)

- Proximity to Oak Dam: Located just 2 km from BHP’s Oak Dam West, known for its significant discovery (425.7m @3.04% Cu & 0.59g/t Au).

- Geophysical Anomalies: Gravity, magnetics, and magnetotellurics indicate a major feeder system linked to IOCG mineralization.

- Drilling Results: Include 111.6m @ 0.27% Cu and high-grade intercepts of 0.8m @ 12.15% Cu. Additional findings revealed 115m @ 0.62% CuEq from 1040m and 70m @ 0.67% CuEq from 962m.

- Exploration Potential: Features like structural dislocations and HEMQ (Hematite Quartz) presence strengthen its comparison to Olympic Dam. Numerous geophysical hotspots align with gravity survey results, underscoring untapped potential.

Pernatty C

- Location: Near the historic Mt Gunson copper-producing district, a region historically producing 150 Kt Cu and 2.1 Moz Ag with an average grade of 2.44% Cu.

- Geochemical Anomalies: Soil sampling has revealed elevated values of Cu, Zn, and Pb, with pathfinder elements like Co, Ni, As, Bi, and Ag. These anomalies align with historic trends in the Mt Gunson district.

- Drilling Results: Include 1m @ 5.28% Zn, suggesting the edge of a resource body, along with other mineralized zones indicative of sediment-hosted deposits.

- Potential: Represents a compelling target for sediment-hosted base metals and potential zinc-lead-silver mineralization. Planned drilling programs aim to define the dimensions of the resource body.

Lake Torrens (Andamooka-Peninsula)

- Strategic Placement: Situated on the PD1 Lineament Corridor, analogous to Olympic Dam. Positioned at the crossroads of mantle disruptions known to host mega-scale IOCG systems.

- Geophysical Targets: Gravity anomalies identified are 2-3 times the size of Oak Dam’s footprint, emphasizing an exceptional scale of potential mineralization.

- Exploration Stage: High-risk greenfield target with unprecedented discovery opportunities. Advanced surveys suggest alignment with large-scale IOCG systems, making this a priority for further exploration.

Discovery Campaign Led by World-Class Experts

Altair Minerals has assembled an exceptional team of industry-leading professionals to drive its ambitious IOCG discovery campaign at the Olympic Domain Project. With decades of experience and numerous landmark achievements, these experts bring unparalleled expertise to one of the most promising exploration initiatives in the region.

Chris Anderson – A Pioneer in Geophysics and Exploration

Chris Anderson, a highly respected geophysicist with over 40 years of global mineral exploration experience, joins Altair Minerals as a Technical Advisor to the Board of Directors. Anderson’s illustrious career is highlighted by his instrumental role in the discovery of the Carrapateena IOCG deposit in South Australia, a project that was later acquired by BHP for AU $9.6 billion after becoming the flagship asset of Oz Minerals.

His expertise lies in geophysical modeling and targeted drill planning, crucial to identifying and unlocking world-class deposits. Beyond Carrapateena, Anderson has contributed to major discoveries worldwide, including copper deposits in Zambia and gold deposits in Tanzania. His deep understanding of the Gawler Craton’s geology and track record of success make him a vital asset in guiding Altair’s exploration programs toward transformative outcomes.

Dr. Ken Cross – A Renowned Authority on IOCG Systems

With a career spanning 35 years, Dr. Ken Cross is a recognized leader in the field of IOCG system exploration. He joins Altair Minerals as a Technical Advisor (Geology), bringing profound expertise in targeting large IOCG deposits. As a former Senior Research Geologist at Olympic Dam, Dr. Cross played a critical role in advancing the understanding and development of one of the world’s most significant copper-gold-uranium deposits.

His contributions extend to various mineral systems, including nickel, silver-lead-zinc, and gold, providing a well-rounded approach to exploration. Dr. Cross’s comprehensive knowledge of IOCG geological modeling and his ability to identify highpotential targets will underpin Altair’s strategy for unlocking the full potential of the Olympic Domain Project.

Steven Cooper – A Visionary Leader in Exploration Management

Steven Cooper, with over 35 years of experience managing mineral exploration programs, takes on the role of Exploration Manager for Altair Minerals. His expertise encompasses all stages of exploration, from project initiation and field data collection to analysis and reporting. Cooper’s career is distinguished by his ability to deliver results, having worked with a diverse client base through his own exploration consulting firm.

As a Fellow of the AusIMM and the Geological Society, Cooper’s leadership will ensure the effective execution of strategic decisions and exploration plans at key Altair projects, including the Olympic Domain and Wee MacGregor Copper Project. His hands-on approach and deep industry insights will drive the success of the discovery campaign.

A Unified Team Driving Success

Together, Chris Anderson, Dr. Ken Cross, and Steven Cooper form a powerhouse team that embodies expertise, innovation, and vision. Their collective experience, bolstered by a proven track record in major discoveries, positions Altair Minerals to achieve groundbreaking results at the Olympic Domain Project. With their guidance, the company is well-equipped to explore and capitalize on the immense potential of the Gawler Craton’s IOCG systems.

The unique combination of advanced technology, expert leadership, and proximity to world-class deposits positions this project as a landmark opportunity in the global IOCG space.

Detailed Conclusion: Why Altair Minerals (ASX: ALR) is a Superior Investment Opportunity

Altair Minerals (ASX: ALR) offers a unique and compelling investment case, driven by its exceptional resource potential, strategic project locations, undervalued market position, and alignment with macroeconomic trends shaping the global copper market.

Exceptional Resource Potential: The IRKA project, Altair’s flagship asset, is positioned as a globally significant copper-gold resource @ 0.94% CuEq. This resource rivals some of the largest copper deposits globally, positioning Altair among elite companies despite its current exploration-stage status. Additionally, the resource includes multiple mineralisation systems, such as porphyry-skarn deposits, offering diversification into by-products like gold and iron. These contribute to the economic viability of the project and provide resilience against market fluctuations in copper prices.

Strategic Location Advantage: Altair’s projects, particularly the IRKA project in Peru, are situated in geologically rich regions with proximity to some of the world’s largest copper mines, such as MMG’s Las Bambas and Glencore’s Antapaccay. The location benefits from:

- Cost-efficiency: Exploration and drilling costs are estimated to be significantly lower than global averages.

- Established Infrastructure: Paved roads, power, and water availability reduce logistical challenges and accelerate project timelines.

- Proximity to Markets: Located in the Andahuaylas-Yauri Belt, Altair benefits from regional expertise and shared infrastructure, further lowering operational risks and costs.

In contrast, many peers operate in regions with logistical or geopolitical challenges, such as Botswana (SFR) or Oman (AUQ), making Altair’s location a clear competitive advantage.

Undervalued Market Position: Altair’s market capitalisation of AUD 12.89 million and enterprise value of AUD 117 million present a significant value gap compared to peers like Hannan Metals. Despite comparable or superior resource potential, Altair remains undervalued, providing an attractive entry point for investors. This valuation discount is expected to narrow as Altair progresses its projects to development and production, offering substantial upside potential.

Alignment with Global Copper Trends: The global copper market is poised for sustained growth, with demand projected to rise from 31 million tonnes in 2023 to 70 million tonnes annually by 2050, driven by:

- Urbanisation and Infrastructure Development: Emerging markets like China and India are driving copper-intensive construction and electrical systems.

- Energy Transition: Renewable energy systems, electric vehicles (EVs), and associated infrastructure are increasingly reliant on copper. By 2050, the energy transition alone is expected to account for more than 70 million tonnes of annual copper demand.

- Technological Advancements: Innovations in telecommunications, data centers, and AI are further accelerating copper consumption.

Altair’s projects are well-positioned to capitalise on these macroeconomic drivers, with its high-grade resources and operational readiness making it a likely beneficiary of these trends.

Exploration Upside and De-risked Development Path: While Altair is in the exploration stage, its advanced exploration progress, such as the identification of significant conductive anomalies and high-grade sampling results, de-risks the investment. Active mining licenses and strong community relations reduce permitting delays and operational risks.

Altair’s readiness to transition into the development phase positions it for rapid value creation, offering investors a potential return on investment that exceeds many of its peers already in production.