Brightstar Resources – Building Western Australia’s Next Gold Miner

Brightstar Resources Limited (ASX:BTR) is a Perth-based junior gold exploration and development company. Hosted in the prolific eastern goldfields of Western Australia, Brightstar has a significant JORC Mineral Resource of 21Mt @ 1.5g/t Au for 1,016,000 ounces Au.

The BTR dream is to build a profitable, sustainable modest scale gold producer (40-50kozpa) in WA and use the positive cashflow to unlock further opportunities with M&A or simply organic expansion (either increase plant throughput or target higher grades to improve production profile).

OVERALL INVESTMENTS THESIS:

- Brightstar commissioned an independent valuation of their existing mill and associated site infrastructure. This report has valued the Brightstar Plant and associated infrastructure at $60.9 million on an “as new” replacement value basis. Hence the replacement value is now two times the companies entire market capitalisation.

- Low Capital requirements in the foreseeable future with recent capital raise completed and profits from JV with BML due in Q1 2024. Plant re-furbishment will require capital but likely to be non dilutive in nature.

- When a sector is in a depressed state, the need for capital places enormous pressure on the share price. If Brightstar can get its small-scale operation successfully into production, then the need for future capital disappears. The cashflow from operations is then used to scale the business up and ramp up exploration. As per ALK trajectory, Tomingley Gold Mine in NSW has been doing ~50kozpa for years and consistently beating guidance and making money. ALK now have $94m cash in the bank, and then discovered the 10Moz Boda deposit essentially using funds from Tomingley.

- Directors financial incentives are aligned with shareholders as they own a large percentage of the register and performance milestones are very difficult to achieve.

- Extensive drilling planned for existing brownfields assets over the next 12 months which will be funded with existing capital as well as payment from the JV with BML which is expected to bring in $3.5m to $4m in non-dilutive cash. Add the existing $3.5m in cash, Brightstar has a very healthy cash balance.

- Scoping study shows $BTR can establish a low CAPEX high Margin operation in a relatively short period of time. Low risk start-up with utilisation of 3rd party processing facilities at project commencement eliminating ‘new build’ construction and commissioning risks, associated high capital burdens and onerous debt / hedging conditions.

BRIGHTSTARS LEADER:

BTR is led by Managing Director @alex_rovira7 who has both a geology and finance background, and post studies worked in investment banking for ~10 years specialising in small cap resources companies. He assisted companies with everything from strategy / corporate advisory services and capital raisings, to M&A ideas and execution.

He spent a lot of time dealing with Boards and also the buy side (instos and HNWs/brokers), which has given him good experience and ability to manage expectations on both sides, yet understands what the investors actually want to see. He’s worked with companies all the way from exploration stage through development and into production, so has first-hand experience in how companies manage that transition.

Alex has purchased a significant number of shares on market, or via placements, since his appointment. Also, most of his performance milestones are very difficult to achieve and if he’s ultimately successful then these milestones will mean significant increase in the company’s share price.

The milestones are as follows:

Tranche 1: Alex Rovira remaining continuously employed or otherwise engaged by the Company (or any other Group member) for a period of 24 months from the Commencement Date

Tranche 2: The delineation of a Mineral Resource Estimate of at least 1.25Moz Au above 1.3g/t Au

Tranche 3: The commencement of commercial production at the Company’s processing plant of at least 10,000oz

Tranche 4: Gold production of 100koz or greater of contained gold metal.

Tranche 5: The Company achieving either: (i) a Market Capitalisation of greater than $50,000,000; or (ii) a 20-Day VWAP of greater than $0.04

Tranche 6: The Company achieving either: (i) a Market Capitalisation of greater than $75,000,000; or (ii) a 20-Day VWAP of greater than $0.06 issue.

COMPARING ALKANE AND BRIGHTSTAR:

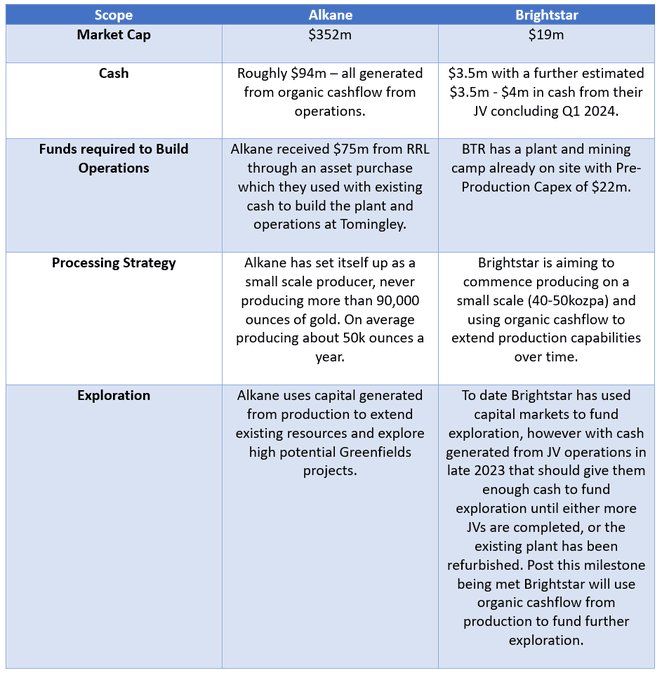

The best analogue to use to compare Brightstar’s strategy to is Alkane Resources’ (ASX:ALK) Tomingley Gold Mine in NSW. That has been doing ~50kozpa for years and consistently beating guidance and making money. ALK then used the funds generated from production to fund exploration that ultimately led to the discovery of the 10Moz Boda deposit.

JV WITH BML:

Brightstar has also commenced mining operations at the Selkirk Deposit within the Menzies Gold Project. The Joint Venture partner BML Ventures Pty Ltd safely completed the first blast of the open pit cutback and haulage of ore to Genesis Minerals’ Gwalia Processing Plant is scheduled for February 2024. This JV is estimated to bring in between $3.5m – $4m in cash flow to the company in early 2024.

Selkirk is just one of the company’s high-grade prospects and BTR is further exploring if any of its other assets outside of the scoping study resource are suitable for a JV type operation to bring in more non-dilutive cash in the future.

NEXT STEPS FOR BRIGHTSTAR:

Ultimately, BTR stands out from other junior gold explorers on the ASX as it will soon be able to generate its own non-dilutive capital. In a depressed gold market, this is incredibly important. In the short term, the company will be focused on executing significant exploration programs at both Cork Tree Well and the Menzies Gold Project. In parallel the company will continue to focus on the development of a Pre-feasibility & Definitive Feasibility Studies for the Laverton Processing Strategy.

Ongoing Research Articles

BTR Merger Acquisition

Brightstar – Aggressive Growth Strategy Sees BTR Increase Total Resource To ~3.0Moz Au It was only recently that we were updating the market on Brightstar’s (BTR) major project acquisition [...]

Brightstar Acquires Linden Gold Alliance

Brightstar – Australia’s Newest Gold Producer Since our last update in November 2023 (Brightstar November 2023 Update X), BTR has been achieving milestone after milestone, including delivering on becoming [...]