Gold Reclaims Its Crown in 2025

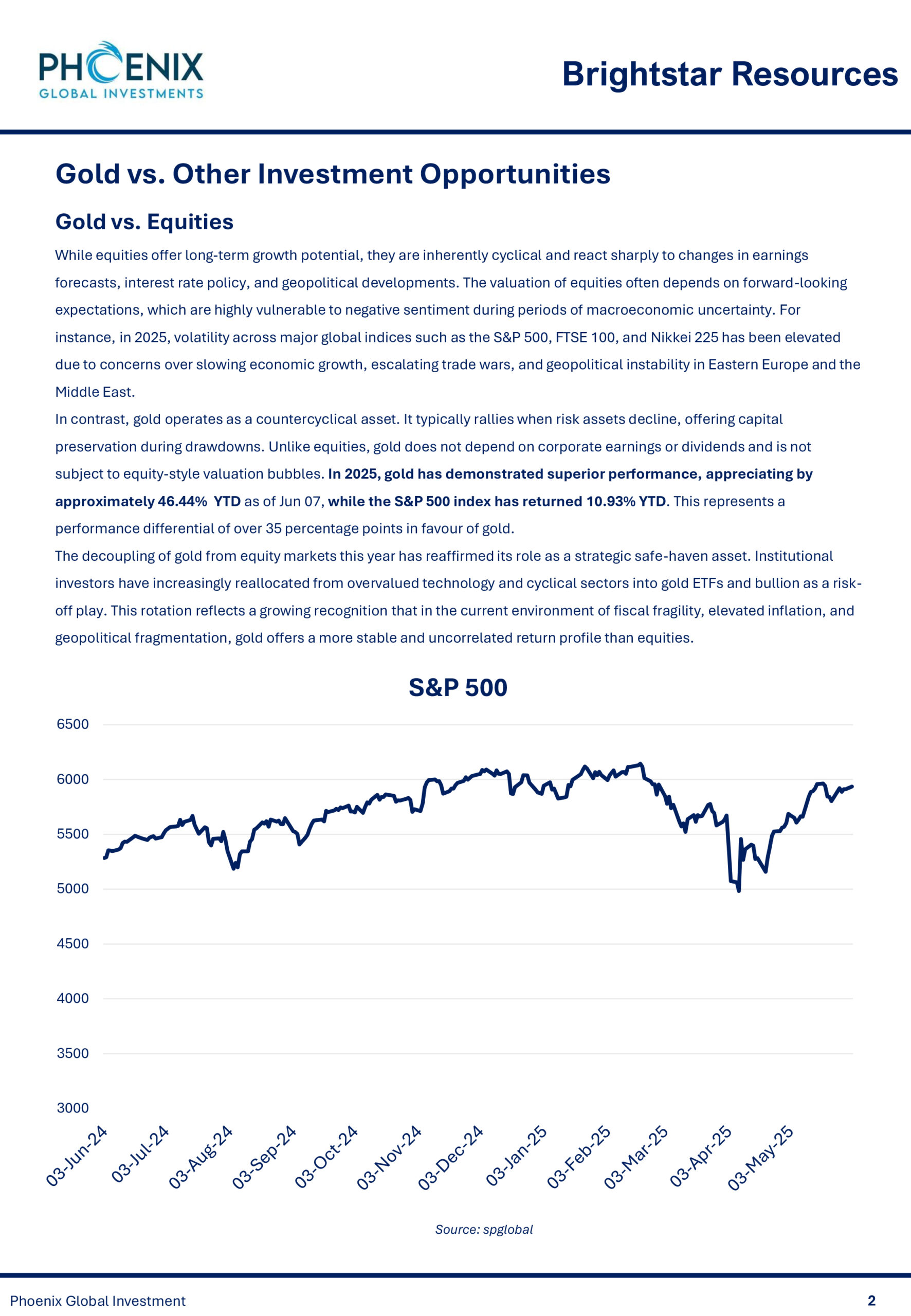

In an increasingly unpredictable global economy, gold has reasserted its dominance as a premier investment asset. The data for 2025 paints a compelling picture: gold has outperformed equities, cryptocurrencies, and bonds not only in returns but also in resilience. With a last 1-year return of over 46.44%, it has significantly outpaced the S&P 500, Bitcoin, and U.S. Treasuries, reaffirming its role as a reliable hedge in times of market stress.

Key drivers such as persistent inflation, negative real interest rates, geopolitical fragmentation, and a weakening U.S. dollar have all aligned to support gold’s resurgence. Additionally, structural shifts like the BRICS+ gold-backed currency initiative and record central bank accumulation underscore gold’s evolving role—not just as a store of value, but as a strategic monetary asset in a multipolar financial system.

As the world navigates high inflation, slowing growth, and de-dollarisation, gold is no longer just a safe haven, it’s a strategic core holding. For investors seeking stability, diversification, and protection against systemic shocks, 2025 has made one thing clear: fortune truly favors the gold.

Read the full report: Click Here