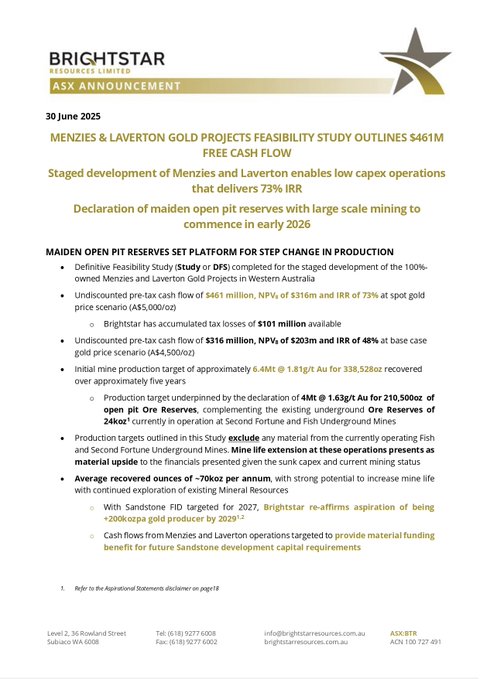

Brightstar Resources (ASX: BTR) has delivered a robust DFS for its 100%-owned Menzies & Laverton Gold Projects in WA, outlining a staged, low-capex development pathway with strong returns.

Key metrics:

- $461M pre-tax free cash flow (undiscounted) at $5,000/oz gold

- $316M NPV8 and 73% IRR

- Payback in just 1 year post plant commissioning

- Total production: 338koz over 5 years (~70kozpa)

- C1 costs: $2,388/oz | AISC: $2,991/oz

- Peak funding requirement: ~$120M

- $15M cash on hand + ongoing cashflow from Second Fortune Mine

- Letters of intent received for up to 70% debt funding

Mining to commence in H1 2026, starting with Lady Shenton. Processing via new Laverton plant and third-party Paddington facility. Supports Brightstar’s TARGET200 vision: 200kozpa by 2029.

Link to the Announcement: Click Here