Company: Pioneer Lithium Ltd

Ticker: PLN

Sector: Lithium

Macro Environment, Company Background & Recent Performance

In 2023, the lithium sector has faced significant headwinds with the spot price declining more then 85% in the past 12 months. Whilst bearish forecasts have re-based near-term earnings expectations significantly lower, further weakness may still be a possibility, consequently it does however present some attractive opportunities for those with a longer-term view. Ultimately, rightly or wrongly, whatever narrative has pushed this spot price lower, the more severe the resulting supply response will become. And as a further consequence, the stronger the future recovery will have to be once demand conditions recover in order to induce new supply from a heavily damaged lithium industry. It is important to recognise that the green energy revolution heavily relies on lithium and these fluctuations are to be expected in a long-term uptrend of a secular shift, predominately driven by the need for Electric vehicles and energy storage systems.

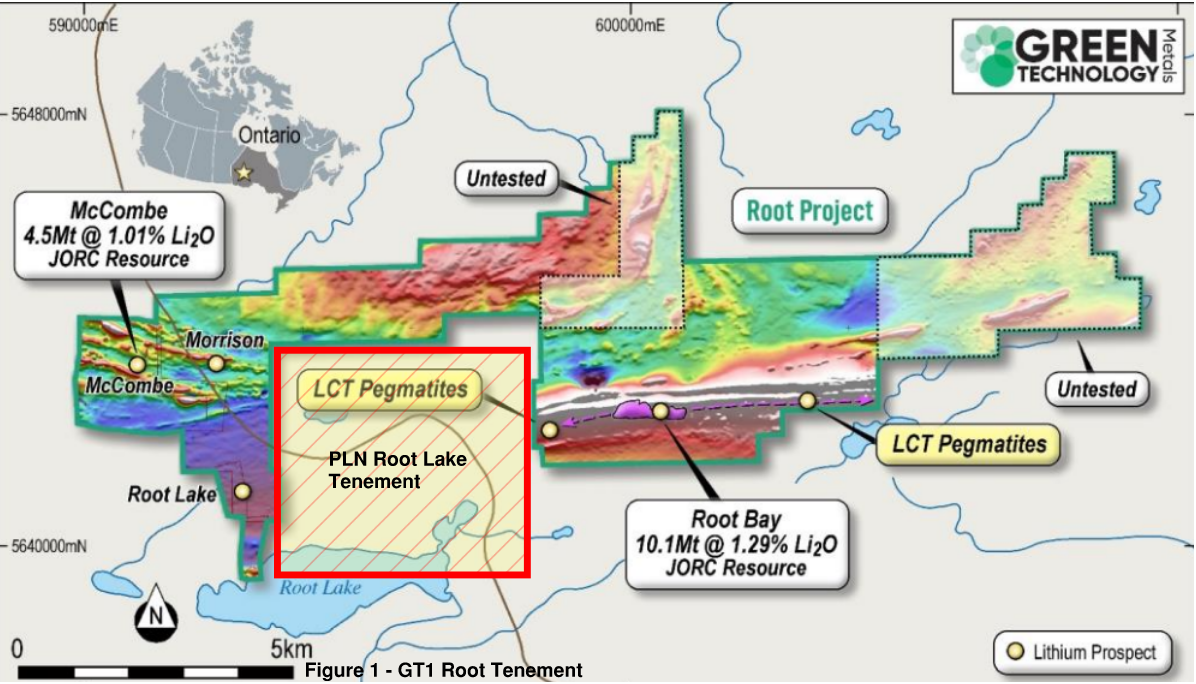

PLN commenced trading on the ASX 28th September 2023 following an oversubscribed IPO which raised $5.0 million, which saw the share price reaching highs of $0.45 within days of listing. PLN boasts a multi-asset portfolio with three highly prospective battery/critical minerals (lithium) projects totalling ~171km2 and ideally located in Northern Ontario and in James Bay Quebec, all with access to the fast-growing North American battery raw material market. Initial focus has been on the strategically located Root Lake Lithium Project in north-west Ontario, which sits directly between Green Technology Metals’ (ASX:GT1) Root Bay and Morrison/McCombe lithium deposits.

Despite positive onsite fieldworks and milestone achievements which have only increased the prospectivity of its tenement’s, PLN share price has correlated with the overall bearish sentiment towards the lithium sector and settled back towards its IPO listing price between $0.16 – $0.20. PLN now boasts an attractive market capitalisation of ~$7.5 million and robust cash balances of ~$2.8 million. The low market capitalisation and ample cash reserves provides a solid foundation for executing its exploration strategies without immediate capital constraints and the requirement for short to medium term capital raises. Concurrently, it also now provides an attractive investment thesis with significant upside if any significant exploration results are achieved.

Cash & Expenditure

- Cash held – ~$2.8 Million

- Debt – $0

- Staff/admin cash burn (average over two quarter) – $330,000

- Total average cash burn per quarter (average over two quarter) – $889,000

The overall staff and administration cash burn is slightly higher then would be preferable, however provided PLN have only recently listed on the ASX, increased administration costs are to be expected and it is probable that these costs will reduce in future quarterly reports. PLN closed the December 2023 Quarter with a cash balance of $2.8 million which will allow the company to undertake its 2024 drilling programs, specifically at its Root Lake project, in addition to further on-site field work for drill target planning at its Benham & LaGrande projects. Furthermore, PLN cost expenditure shows a total 65% of funds have been spent on exploration of its projects when compared to administration and staff expenditure, demonstrating a management team committed to driving share price growth as opposed to being a ‘lifestyle’ company. Between 60% and 70% is considered reasonable.

Board of Directors

PLN have a highly experienced board and management team with recent proven success in the ASX junior mining space, including lithium, demonstrating a clear propensity for project acquisitions, discoveries and resource definition in quick succession. Collectively, the team have completed in excess of 50,000m of drilling in Canada in their various roles and have vast experience in hard rock lithium projects, dovetailing with the needs of PLN.

- Executive Chairman – Robert Martin: Robert brings more then 25 years’ experience to this role, ranging across sectors including mining and mining services, manufacturing and capital markets. He currently holds the positions of non-executive chairman of Critical Resources (ASX:CRR), non- executive chairman of Battery Age Minerals (ASX:BM8), non-executive chairman of Equinox Resources (ASX: EQN), non-executive director of Parkd (ASX: PKD) and director of TSX-V listed Volt Carbon Technologies (TSX-V: VCT). Notably of recent times, Robert has played a major role at Critical Resources (ASX: CRR), helping lead the company through its flagship project acquisition (Mavis Lake, Ontario Canada), discovering a lithium deposit and defining its maiden MRE (8Mt @ 1.07% Li20) all within 11 months.

- Non-executive Director – Nigel Broomham: Nigel is a geologist with over 12 years industry experience, including over 10 years in the battery metals sector, specifically in lithium and manganese. He is currently the General Manager of ASX listed lithium explorer, Battery Age Minerals (ASX: BM8). Prior to joining Battery Age Minerals, Nigel held leadership roles with ASX-50 lithium producer Pilbara Minerals (ASX: PLS) in exploration, resource development and mining production. As Head of Geology at Pilgangoora, he was extensively involved in the exploration and development of the world-class Pilgangoora Lithium-Tantalum Project and was tasked with leading the geology team from exploration through to production.

- Non-executive Director – Agha Pervez: Agha currently holds the role of Executive Chairman for Viridis Mining and Minerals Limited (ASX:VMM), Executive Director and Chief Financial Officer of Equinox Resources Limited (ASX: EQN). Agha also holds the role of Chief Financial Officer for Battery Age Minerals Limited (ASX: BM8) and previously held the roles of CFO and Company Secretary at Resonance Health Limited (ASX: RHT). Mr Pervez was instrumental in the corporate restructuring of RHT in 2017 and contributed to the significant growth of RHT’s market capitalisation during his tenure. Recently, Agha has steered ASX:VMM through a rare earths project acquisition in Brazil and subsequent Ionic Adsorption Clay discovery, which has the potential to become a world class project. This has seen ASX:VMM share price increase from ~0.20 to highs of ~2.00 within 6 months and is now in the process of developing their maiden JORC resource, scheduled for releasee mid 2024

Director Shareholdings, Salaries & Alignment With Shareholders

- Total director shareholdings – 8,482,501 ordinary shares (18% of register undiluted) acquired for ~$641,000 @ average of $0.08 per share

- Total director shares acquired on-market and/or in placements only – 2,047,500 ordinary shares (4.4% of register undiluted) acquired for ~$421,000 @ average of $0.21 per share

- Note – Executive Chairman & Non-executive Director purchased ~$37,000 on-market at premium to current share price within last 3 months

- Remaining director shares – 6,375,000 ordinary shares (13% of register) were acquired via seed raisings for a total of $220,000 at $0.02 per share & $0.10 per share

- Total director options – 9,000,000 options with an exercise price of $0.25 expiring 28/09/26 (total director shareholding amounts to 25% of register fully diluted)

- Board salaries

- Executive Chairman – $100,000 pa

- Non-executive Directors – $48,000 pa

Summary: Whilst a significant portion of the director holdings have been acquired at a discount to the current share price, these seed shares were purchased by directors & key shareholders who are assumed to have played a significant role in the development of PLN and listing on the ASX. Nonetheless, the board of directors have collectively spent ~$421,000 at an average of $0.21 per share, purchasing on-market and/or in the initial IPO placement, which is a premium to the current share price. With regards to the director options, if exercised provides directors with a significant percentage of the register. Whilst it would be preferable from an investor perspective to see a higher exercise price (higher incentive), $0.25 is not unreasonable in an IPO and from the current share price does provide a fair incentive. Furthermore, approximately ~40% of the issued share capital on an undiluted basis, and approximately ~26% on a fully diluted basis (assuming all Options and Performance Rights are issued and exercised), are escrowed for a period of 24 months, ensuring a large percentage of the register cannot be sold until 28/09/25. Overall, PLN directors hold a significant interest in the company and are aligned and incentivised to add value for themselves and subsequently the shareholders.

Top 20 Register

PLN maintains an incredibly tight capital structure, with the Top 20 shareholders holding ~80% of the register undiluted, and ~54% of the register fully diluted. Despite the share price steadily declining, the average volume of shares traded over 4 weeks is ~67,000 (~$10,000 at today’s SP) which is extremely low, and given it is an extremely tight register any movement to the upside has the potential to be significant due to illiquidity of shares. It can be ascertained that approximately ~43% of the Top 20 shareholders are made up of directors, vendors, lead brokers and known associates of the before mentioned. This make up is considered positive given the past history of these shareholders is that of a long-term view in addition to significant past investment successes. These same shareholders have also participated in the IPO purchasing approximately ~$900,000 at $0.20, which is higher than the current share price.

Company Assets, Progress & Strategy

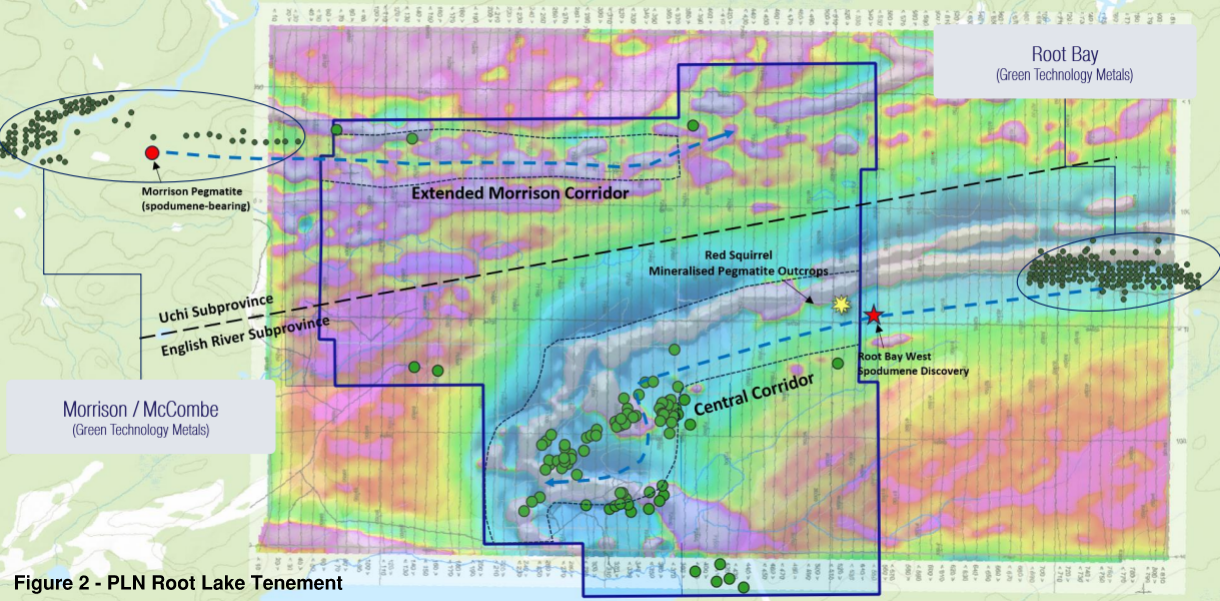

- Root Lake Project, Ontario Canada (90% ownership, 19km2) – The Root Lake Project is PLN’s flagship project and is strategically positioned between Green Technology Metals (ASX:GT1) two existing deposits, Root Bay (10Mt @ 1.29% Li20) and McCombe (4.5Mt @ 1.01% Li20). Additionally, ASX:GT1 holds an initial exploration target of 20-24Mt @ 0.8 to 1.5% Li20 for these two resources. When reviewing the data, there is compelling potential of ASX:GT1 lithium mineralisation to continue into PLN’s tenement. ASX:GT1 announced in November 2023, following extensional drilling to their Root Bay deposit, that they had extended mineralisation to the West with multiple spodumene bearing drill intercepts including a significant drill intercept of 23.3m @ 1.16% from 197m. These drill intercepts straddle the Eastern border of PLN’s tenement as depicted below in Figure 2. PLN’s recent field work program identified 85 pegmatite outcrops along-trend from ASX:GT1’s Root Bay deposit, which are up to 10m wide and are exposed over lengths of up to 140m, typically displaying fractionation indicators and accessory minerals associated with LCT pegmatites. In conjunction, PLN have identified spodumene-bearing pegmatite outcrops at their Red Squirrel prospect (refer Figure 2), which again is along the Central Corridor in the south-eastern portion of the Root Lake Project area, which could represent a continuation of the Root Bay pegmatite system. Moreover, during the 1950’s, there was some early-stage exploration for base metals undertaken, which did by chance yield drill results confirming several coarse grained, spodumene rich pegmatite intercepts including 2m @ 2.42% Li2O, 2m @ 2.83% Li2O & 5.3m @ 1.86% Li2O, located in the Southern & North West portions of the tenement. Currently, drill permits have been approved and PLN are in discussions with drilling contractors.

- Benham Lithium Project, Ontario Canada (100% ownership, 13km2) – The Benham project is located 70km from Critical Resources’ (ASX: CRR) Mavis Lake lithium project and wedged between Patriot Lithium’s (ASX:PAT) Dryden project and Canada-listed Beyond Lithium’s Victory and Victory West projects, which all have varying degrees of lithium exploration success. The initial fieldwork program identified spodumene-bearing pegmatite outcrops in the north-west portion of the Benham Lithium Project area which included multiple mineralised veins exposed over a length of approximately 1.5-2m and containing cream, euhedral and very coarse-grained unaltered spodumene. This mineralogy is aligned with that reported on Beyond Lithium’s neighbouring Victory Project. Assay results from channel sampling have now confirmed visual estimates of spodumene mineralisation at an identified 40m-long pegmatite, north-west corner of the project area with best assay results showing up to 4.61% Li2O. Based on these results PLN have decided to expedite exploration at the project.

- Lauri Lake Project, Ontario Canada (100% ownership, 106km2) – The Lauri Lake Project is an early- stage exploration project. There are no current exploration targets at Lauri Lake Project as little exploration has been conducted so far. However, Lithium spodumene-bearing pegmatites have been identified on several Properties (Cancet, Corvette, Corvette Far East and Brisk) which are all within the range of 12 – 35km.

- LaGrande Project, Quebec Canada (100% ownership, 47km2) – PLN’s LaGrande project is located in the active James Bay lithium region of Quebec and is made up of three prospects (La Grande-River, La Grande-Quatre West, and La Grande-Quatre East). The project is located strategically along trend from Patriot Battery Metals’ (ASX: PMT) Corvette lithium project, 20km west of Winsome Resources’ (ASX: WR1) Cancet project and 25km north-east of Loyal Lithium’s (ASX: LLI) Brisk project. Nine pegmatite outcrops were identified at the LaGrande East and West Claims and will be further investigated during the summer 2024 field programs.

Peer Comparison

| Equal & Comparable Peers | ||||

| PLN | PAT | MRZ | PIM | |

| Market cap (Fully Diluted) | ~$7,500,000 | ~$11,110,000 | ~$9,350,000 | ~9,425,096 |

| Enterprise valuation | ~$4,700,000 | ~$9,469,000 | ~$7,462,000 | ~7,125,096 |

| Cash | ~$2,800,000 | ~$1,641,000 | ~$1,888,000 | ~2,300,000 |

| Debt | $0 | $0 | $0 | $0 |

| Top 20 Ownership | 80% | 43% | 51% | 58% |

| Director Ownership | ~18% | ~6% | ~5.5% | ~19% |

| Project Location | Ontario, Canada | Ontario, Canada | Quebec, Canada | Quebec, Canada |

| Tenement Size (km2 | 19km2 | 800km2 | 536km2 | 72.7km2 |

| Flagship Project | Project | Gorman Project | Hydra Lithium Project | Adina East Lithium Project |

| Ownership | 90% | 100% | 75% | 75% |

| Exploration Stage | Pre-drilling Early-stage exploration |

Pre-drilling Early-stage exploration |

Pre-drilling Early-stage exploration |

Pre-drilling Early-stage exploration |

| Exploration Results | * 85 pegmatite outcrops *Confirmed spodumene bearing outcrops * Historical drill results including:- 2m @ 2.42% Li2O, – 2m @ 2.83% Li2O – 5.3m @ 1.86% Li2O |

*Channel samples:

– 5m @ 1.7% Li20 *Rock chip samples: – 3.36% Li2O |

*Channel sampling assays:

– 6.05m @ 1.78% Li2O *Confirmed spodumene in rock chips |

*Multiple pegmatites mapped |

| Other Projects | *3 x Lithium Project, Canada | *6 x Lithium Project, Canada *3 x Lithium Projects, USA |

*1 x Gold-Copper Nickel Project, Canada | *2 x Lithium & Basemetals Projects, Quebec Canada *2 x Kaolin-Halloysite & Uranium Projects, South Australia |

| Comments | *Market may be pricing at a premium due to large quantity of projects and/or due to the Gorman tenement size | |||

Equal & Comparable Peer Analysis Comments – PLN offers an attractive investment thesis when compared to it’s peers, specifically noting that PLN are holding more cash and have a lower market capitalisation, significantly lowering its risk profile and upside potential in comparison. Further to this this, PLN have confirmed historical drill results in addition to positive fieldworks at their Root Lake Project which have strengthened the expectations of the continuation of ASX:GT1’s Root Bay pegmatite system into the PLN claim area.

| Risk Peers | |||

| RBX | BMM | MEG | |

| Market cap (Fully Diluted) | $6,200,000 | ~$5,400,000 | $5,850,000 |

| Enterprise valuation | $5,384,000 | ~$4,211,000 | $4,708,000 |

| Cash | $816,000 | ~$1,189,00 | $1,142,000 |

| Debt | $0 | $0 | $0 |

| Top 20 Ownership | ~49.5% | ~68% | ~38.5 |

| Director Ownership | ~5.4% | ~2.4% | ~3.9% |

| Project Location | Quebec, Canada | Ontario, Canada | Quebec, Canada |

| Tenement Size (km2 | 51km2 | 43km2 | 130km2 |

| Flagship Project | Wali Project | Gorge Project | Cyclone Lithium Project |

| Ownership | 100% | 100% | 100% |

| Exploration Stage | Pre-drilling | Drilled | Pre-drilling |

| Exploration Results | *First pass rock chip assays did not confirm high Li20 grades associated with Spodumene | *First pass drill results between 1.02m to 16.83m and containing visible spodumene ranging from 3 to 20% content. | *First pass rock chip assays did not confirm high Li20 grades associated with Spodumene |

| Other Projects | *1 x Lithium Project, Canada

*1 x REE Project, VIC Australia |

*5 x Lithium Project, Canada

*3 x Tantalum/lithium Projects, Serbia |

*1 x Lithium Project, James Bay Canada

*1 x REE Project, Idaho USA |

| Comments | |||

Risk Peer Analysis Comments – Junior lithium exploration companies with cash levels ~1,000,000, in both Ontario & Quebec jurisdictions of Canada which have announced exploration results which were poorly received by the market have retained a market capitalisation between ~$5.4 million to ~6.2 million. Assuming market sentiment towards the lithium sector remains bearish, this peer analysis suggests an approximate downside risk profile of 20-30% should PLN exploration results not be well received by the market.

| Reward Peers | |||

| LLI | GT1 | WR1 | |

| Market cap (Fully Diluted) | ~$32,700,000 | ~$41,240,000 | ~$120,291,000 |

| Enterprise valuation | ~$26,330,000 | ~$24,537,000 | ~$66,426,353 |

| Cash | ~$6,404,000 | ~$16,703,000 | ~$53,865,000 |

| Debt | $0 | ~$0 | ~$0 |

| Top 20 Ownership | ~45% | ~76% | ~49.6% |

| Director Ownership | ~1% | ~ | ~4% |

| Project Location | Quebec, Canada | Ontario, Canada | Quebec, Canada |

| Tenement Size (km2 | 251km2 | 230km2 | 44km2 |

| Flagship Project | Trieste Lithium Project | Root Bay Lithium Project | Adina Lithium Project |

| Ownership | 100% | 100% | 100% |

| Exploration Stage | Drilled | Mineral Resource & Feasibility Studies | Maiden Resource |

| Exploration Results | *Significant drill results:

*28.8m @ 1.1% Li2O from Surface |

Mineral Resource of 24.9Mt @ 1.13% Li20

Significant drill results: *17.1m @ 1.77% Li20 from 71m |

Maiden Mineral Resource of 59Mt @ 1.12% Li2O

Significant drill results: *107m @ 1.34% Li20 |

| Other Projects | *1 x Lithium Project, Canada *1 x Lithium Project, Nevada USA |

*8 x Lithium Projects, Canada | *4 x Lithium Projects, Canada |

| Comments | |||

Reward Peer Analysis Comments – Despite market sentiment towards the lithium sector remaining bearish, at PLN’s current share price it offers an attractive reward potential. Based on the above peer analysis, it is feasible that drill results which regularly exceed 20m intersections could attain a 400% to 550% increase in market capitalisation from the current share price. Intersections greater than 20m may yield a higher market capitalisation as demonstrated by ASX:WR1.

Short Term Catalysts:

- Drilling to commence at Root Lake Project 2024 with drill permits now approved

- Recommence field campaigns in Summer (June) to delineate a maiden drilling campaign in 2024.

- Recommence field campaigns in Summer (June) 2024 at LaGrande East and West Claims

Highlights:

- Despite bearish sentiment towards the lithium sector, PLN offers an attractive RvR investment thesis as shown within the peer analysis

- PLN boasts a very low market cap

- PLN has sufficient cash reserves to execute its exploration strategy over the coming 4-6 quarters

- Tenements are located within a Tier 1 Jurisdiction which has attractive government grants, exploration tax rebates (up to 40%) and flow through funding. Furthermore, Ontario Canada is emerging as a global leader for battery metals with the jurisdiction committing billions of dollars towards support for mining companies, manufacturers, infrastructure and the like.

- The Root Lake Project is strategically located directly along strike from ASX:GT1, which has proven lithium deposits. PLN fieldworks and historical drilling have confirmed the presence of coarse-grained spodumene-rich pegmatite mineralisation, strengthening expectations the Root Bay pegmatite system continues into PLN claim area

- PLN have an experienced management team with a track record of recent success, having served on the boards of several junior ASX-listed companies. Several board members have also held senior positions with the largest lithium resource companies globally, contributing valuable insights and expertise to the operational dynamics of the organization.

- The board of directors are aligned with shareholder and have been purchasing on-market, creating incentive to generate value for themselves and shareholders

- Extremely tight register with Top 20 holding ~80% of register.

Risks:

- Share price is highly dependent on drill results and may have high volatility

- Market sentiment towards lithium remains bearish and it is difficult to forecast when this may change in the near term. Additionally, market sentiment in the lithium sector has increased downside risk and decreased upside reward in relation to market capitalisations

- More capital will be required in the future, however if company milestones are met then capital raise price should be much higher than current levels.

Ongoing Research Articles

PLN Rare Earth Acquisition

Company: Pioneer Lithium ASX Ticker: PLN Sector: Lithium / REE PLN Secure 730km2 of Prospective Ionic Clay Rare Earth Tenements In Hot Region of Brazil Our ~$7M capped explorer [...]