Company: Traka Resources

ASX Ticker: TKL

Sector: Base Metals / Niobium

Summary Reasons For Investing

- Extremely low market cap & EV

- Cap raise recently completed

- Refreshed board of directors & new strategic direction

- Highly promising projects with encouraging geology

- Looking for project acquisitions

- No debt

What Does TKL Do?

Traka Resources (TKL) is an Australian junior exploration company focused on making a valuable metals discovery at their Gorge Creek Project in NW Queensland, targeting base metals (copper, lead, zinc, cobalt) in addition to exploring for Uranium & Niobium.

Additionally, TKL have a diversified suite of existing project addressing the critical minerals and base metals sectors, with REE (rare earth elements) and niobium the target commodities. TKL are also actively seeking out & reviewing new projects in the battery and base metals sectors.

What is The Sector Thematic?

Base Metals are increasingly becoming strategic materials due to energy security.

Copper which is the third most utilised metal in the world, is pivotal to everything that requires electricity i.e. energy transmission, which is poised to significantly increase over the coming years.

Not only do we have the EV revolution, which is driving increased demand in copper, the ‘AI revolution’ is now estimated to require more power in the US than that of EVs.

Moreover, lead and zinc are the two most widely used non-ferrous metals after copper.

REE, niobium and uranium are also key components of the energy and metal demand now and into the future.

These critical metal inventories are at all times low, however seeing increased demand due to their application in steel protection, batteries, solar panels, offshore wind turbines and EVs.

Surging Base Metal Prices

Most zinc is used to galvanise other metals, such as iron, to prevent rusting on solar panels, wind turbines in addition to zinc-ion batteries:

Figure 1 – Zinc Price Chart

Lead is still widely used for car batteries, pigments, ammunition and cable sheathing:

Figure 2 – Lead Price Chart

Copper is essential for wind and solar technology, energy storage and electrical vehicles, with renewable technology requiring up to five times more than copper then non-renewables:

Figure 3 – Copper Price Chart

TKL Investment Highlights

~$1.3 Million Enterprise Value (EV) with Significant Upside Potential

TKL has a current market cap of ~$2.0M, ~$0.69M in cash (at June 30, 2024), and an enterprise value of ~$1.3M.

At such a low valuation, the market is not currently ascribing any value for future exploration success or a meaningful project acquisition, suggesting the downside is largely already priced in the current valuation, and a significant re-rate is likely should TKL have any success.

For example, Talisman Mining (ASX:TLM) recently announced a base metal discovery at their Dunnings Prospect, (DRRCD0019 – 7.5m at 1.5% Pb, 2.2% Zn, 23.6g/t Ag, 0.3% Cu, 0.31g/t Au from 198m) which saw their market cap reach a peak of $72M.

Should TKL replicate even half of this success, it could see ~18 times return from its current valuation for shareholders.

To put this investment thesis into a visual image – see below:

Capital Raise Done

TKL recently received firm commitments to raise $0.69M to professional and sophisticated investors at an offer price of $0.002 per share, representing a premium of 33% to the last traded price of $0.0015 per share.

This gives TKL approximately ~$1.3M in the coffers to undertake its due-diligence and unravel the potential value of its Gorge Creek Project in addition to evaluate any prospective project acquisitions.

With a low corporate cash burn of ~$165k per quarter, we expect this cash balance will be sufficient to allow the company to advance its assets, and while it looks for new projects.

Major Project Acquisition & Re-Rate?

In our opinion, the most promising aspect of TKL is the potential for a new project acquisition.

Management have stated that they are actively seeking out and reviewing new projects in the battery metals and critical minerals sectors.

With a tiny market cap, low cash burn & healthy cash balance, TKL offers everything we’re looking for when it comes to a low risk, high return play, which is likely to generate outsized returns on any meaningful project acquisition.

Gorge Creek Project Located Adjacent to World Class Base Metal Deposits

TKLs 100%-owned Gorge Creek Project is located within the highly prospective Mt Isa inlier and Carpentaria Province in North Queensland.

The project boasts a favourable structural and geological position, directly along strike from the Walford Creek copper deposit and adjacent to the world-class deposits of Glencore’s McArthur River and Sibanye-Stillwater’s Century.

| Glencore | Aeon Metals | Sibanye-Stillwater | |

| Project | MacArthur River Mine | Walford Creek | Century |

| Deposit | 152Mt @ 9.9% Zn, 4.5% Pb, 46g/t Ag | 72.6Mt @ 1.6% CuEq | 118Mt @ 10.2%, 1.5%Pb, 36g/t Ag |

The Right Geological Setting for a Base Metal Discovery

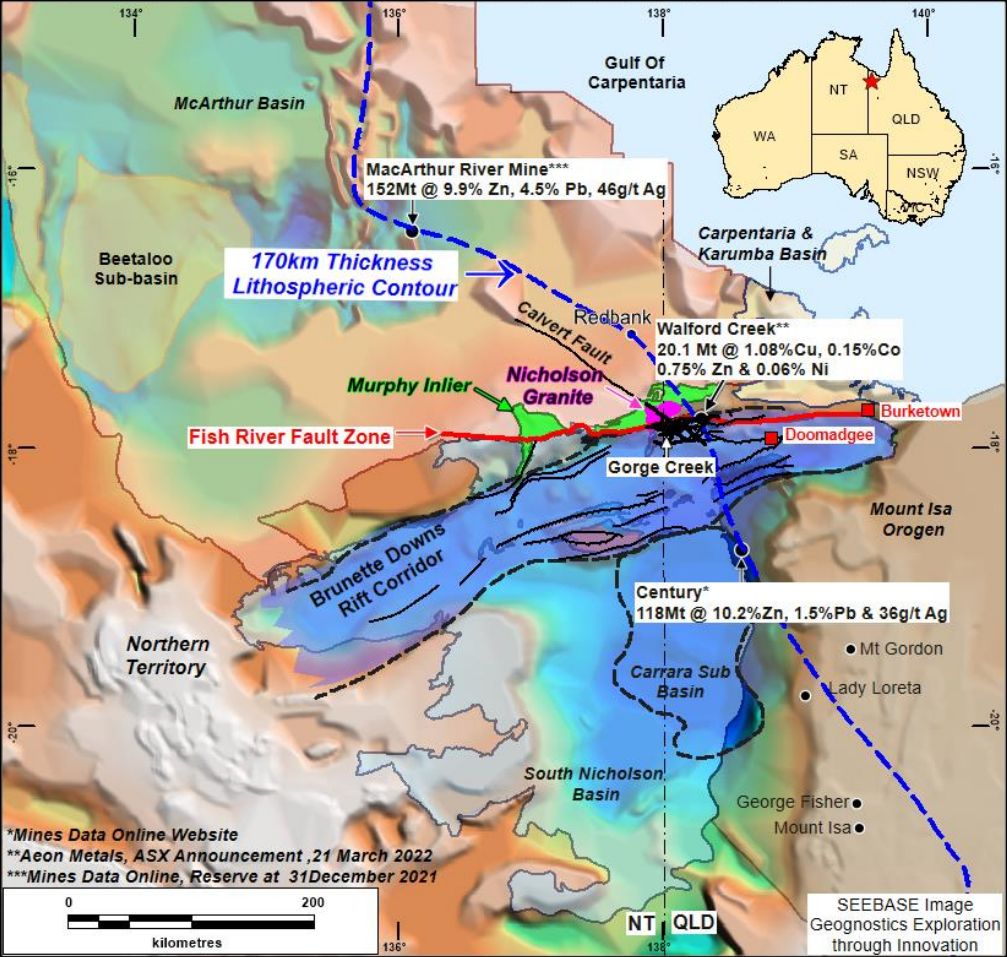

Majority of Australia’s Tier 1 Base Metal deposits are in close proximity to major crustal fault(s), which are located along the lithospheric scale contour where it has an approximately thickness of ~170km (white boundary shown in Figure 4).

As shown in Figure 5, TKL’s Gorge Creek Project, in addition to the MacArthur River, Walford Creek and Century deposits, are all located along the ~170km thick Lithospheric contour boundary. Additionally, TKL’s Gorge Creek Project has several major crustal faults transecting the tenements.

Figure 4 – Lithospheric Scale Boundary

Figure 5 – Gorge Creek Project Location

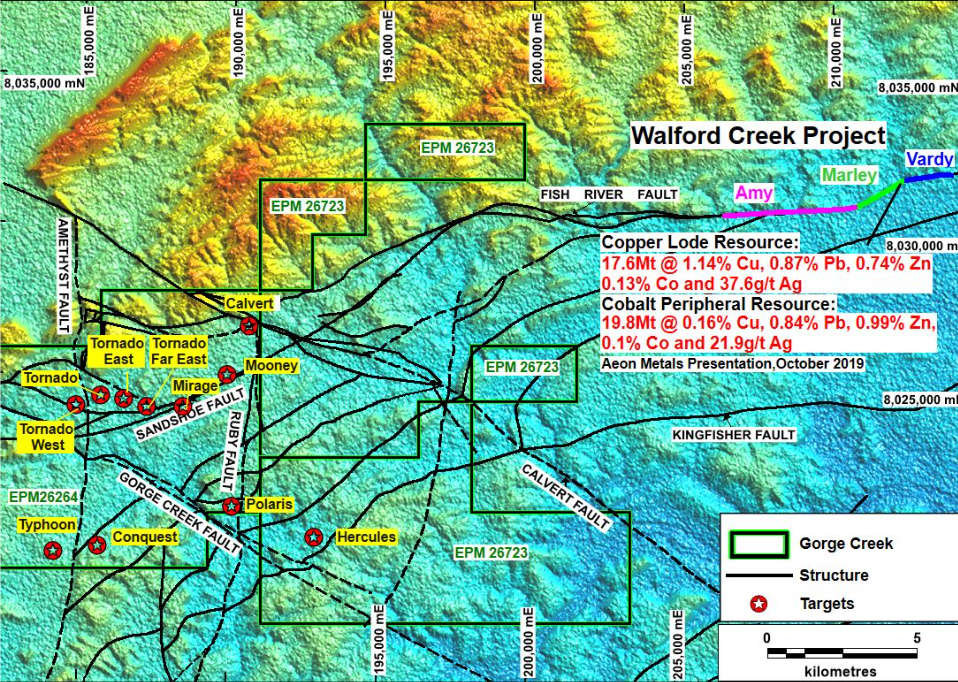

Gorge Creek Has Numerous Walk Up Drill Targets

Shareholders will not have to wait long with previous exploration on site for copper, lead and zinc highlighting numerous high priority targets which are now ready for diamond drilling. TKL is currently negotiating a Heritage Access Agreement with traditional owners to commence drill testing as soon as practical.

TKL’s exploration programs to date have identified SEDEX (Sedimentary Exhalative) type lead and zinc targets, similar to those found at the Century and MacArthur Mines, as well as targets for copper and cobalt mineralisation on the Fish River Fault Zone (FRFZ), the same fault which hosts the Walford Creek 72.6Mt @ 1.6% CuEq deposit ~30km away.

Drilling by Aeon westward along the FRFZ towards Gorge Creek demonstrates that mineralisation continues to persist for many kilometers. This consistent mineralisation trend highlights the prospectivity of the rock units within TKL’s tenement package and supports TKL’s exploration approach, including the numerous drill targets which have been identified.

TKL’s has identified secondary faults off the FRFZ which may be conduits for mineralization and as such, are primary target areas. In addition, TKL has identified coincidental geophysical and geochemical rock chip anomalies, resulting in numerous prospective walk-up drill targets.

Figure 6 – Gorge Creek Drill Targets

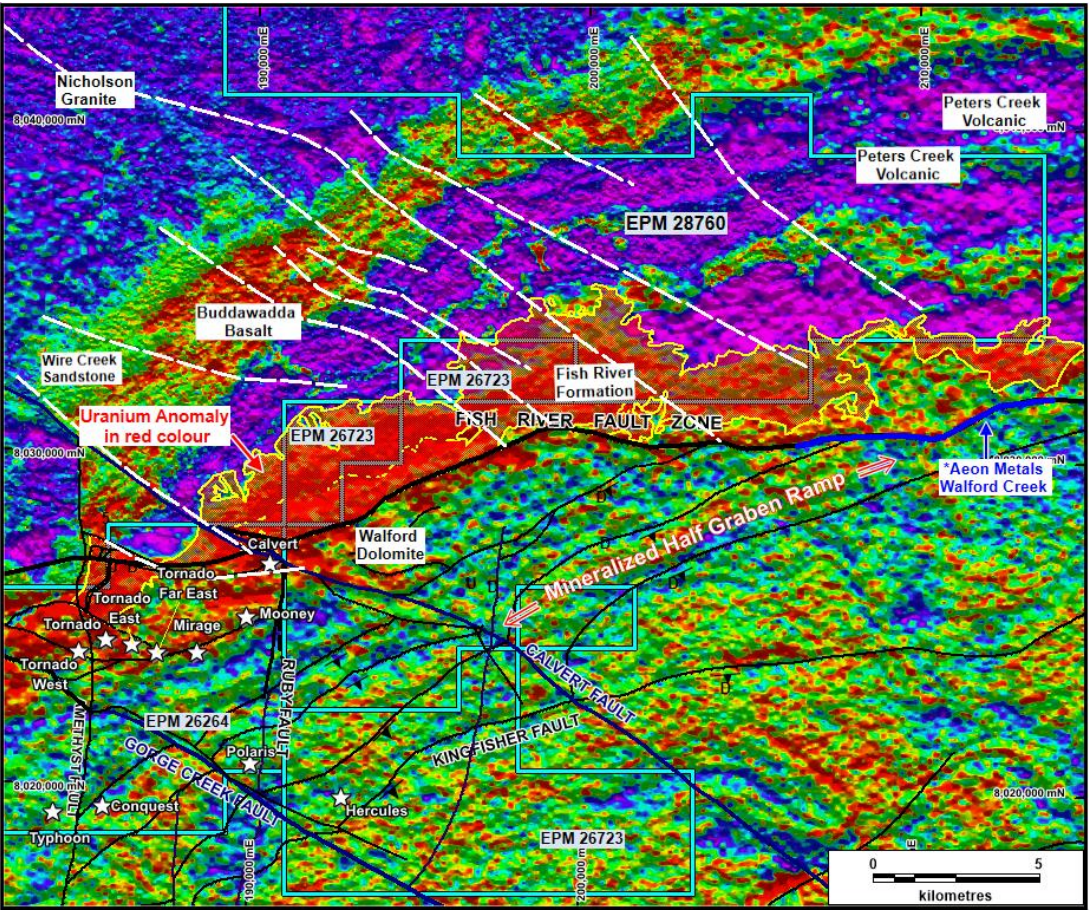

Large Uranium Anomalies Identified

TKL has identified several uranium anomalies, including a 15km long stratigraphic horizon on the shallow Fish River Formation, at its Gorge Greek Project.

The large uranium anomaly demonstrates similar geological characteristics as the Westmoreland Uranium Project 20 kms to the North (Indicated 18.7Mt @ 0.09% U308 (36M Ibs U308) and Inferred 9Mt @ 0.08% U308 (15.9M Ibs U308).

See Figure 7 radiometric image below overlaid with the Gorge Creek tenement, highlighting in red the main uranium anomaly coincident with the Fish River Formation (yellow boundary).

Figure 7 – Gorge Creek Uranium Anomaly

TKL Also Has Strong Company Fundamentals

Refreshed Board & Direction

TKL has refreshed its board of directors and initiated a comprehensive review of its existing assets in addition to evaluating several new business opportunities.

A new and refreshed executive team with lots of short-term news catalysts is exactly what we look for in a low EV play as it typically marks a new strategic direction for the company, following a challenging period, often resulting in old and frustrated shareholders selling us cheap shares.

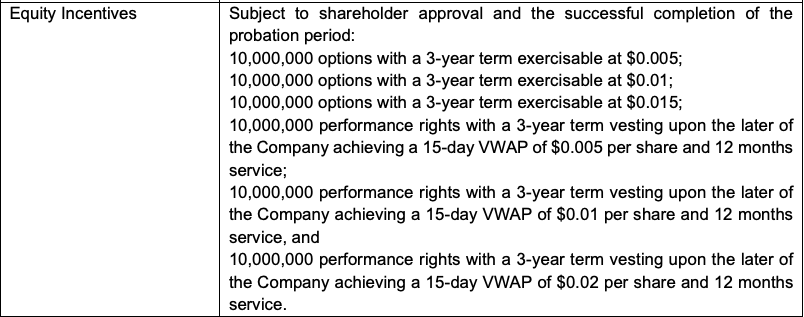

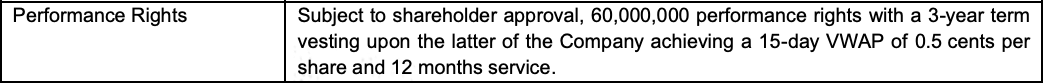

New CEO & Non-Executive Director Performance Incentives Aligned With Shareholders

As a shareholder, we want to see ambitious performance incentives for senior management, and Stephen Lynn the recently appointed CEO has exactly that.

With the share price today at ~$0.001, the minimum incentive for Steve is 5x the current share price and the maximum is 20x.

NED, Joshua Gordon also has some meaningful performance incentives, which if achieved offer 5x return from the current share price.

Base Metal Junior Explorers Peer Comparison

| Traka Resources | Native Mineral Resources | Talisman Mining | Australian Gold & Copper | |

| Market cap | ~$2.5M | ~$8.4M | ~$40M | ~$68M |

| Enterprise valuation | ~$1.3M | ~$6.4M | ~$37.8M | ~53.8M |

| Cash (last qtrly) | ~$.0.69M | ~$2.2M | ~$2.8M | $14.2M |

| Debt | $0 | $0.2M | $0 | $0 |

| Project Location | NW QLD | Far North, QLD | Lachlan, NSW | Cobar, NSW |

| Flagship Project | Gorge Creek Project | Maneater Hill | Lachlan Project | Achilles Projects |

| Significant Drill Results | N/A | – 446m @ 5.5g/t Ag, 0.02g/t Au, 0.13% Zn, 0.06% Pb & 100ppm Cu from 99 | Dunnings Prospect:

Base Metals Zone: – 7.5m at 1.5% Pb, 2.2% Zn, 23.6g/t Ag, 0.3% Cu, 0.31g/t Au from 198m; – 7.4m at 6.7% Pb, 2.9% Zn, 137g/t Ag, 0.2% Cu, 0.24g/t Au from 218.8m Copper-Gold Zone: – 28.3m at 4.03g/t Au, 0.9% Cu, 3.8% Pb, 0.7% Zn, and 26.5g/t Ag from 370.5m |

– 5m at 16.9g/t Au, 1,473g/t Ag & 15.0% Pb+Zn from 112m

– 3m at 19g/t Ag & 19.5% Pb+Zn from 139m – 8m at 1.0g/t Au, 520g/t Ag, 0.6% Cu & 6.2% Pb+Zn from 131m -4m at 0.17g/t Au, 545g/t Ag, 0.2% Cu, 2.9% Pb+Zn from 123m |

Favourable Peer Comparison

We looked at a range of ASX listed base metal explorers in order to assess what the risk & reward profile might look like.

TKL offers an attractive investment thesis when compared to its peers, specifically noting TKLs market cap and enterprise value which is significantly less than its peers.

Recently, the market has reacted favourably to base metal discoveries as demonstrated by ASX:TLM & ASX:AGC, who have reached significant market caps, peaking at ~$72M & ~$143M respectively.

Intriguingly, TKLs EV is ~6 times less than that of ASX:NMR despite both being at relatively similar stages of exploration at their respective projects, noting ASX:NMR only having low grade first pass drill results.

In our opinion this demonstrates that TKL provides the opportunity for multiples of upside on any exploration success or meaningful project acquisition.

Low Risk Profile

TKL is already trading at a shell valuation, multiples lower to its peers and with sufficient funds to undertake an exploration campaign and/or project acquisition.

As we previously advised, the downside appears to have largely already been priced into the company valuation, which inherently lowers TKLs risk profile.

Near Term Potential Share Price Catalysts

- Battery metals & critical minerals project acquisition

- Permit applications to enable land access currently underway in anticipation of exploration programs, including drilling.

- Priority drill program on multiple base metal targets where RC pre-collars are already complete.

- Newly defined REE and uranium targets will be followed up concurrently with exploration mapping/sampling and drill programs.

Investment Risks

- Exploration risk – TKLs projects are considered early-stage prospects and there is an inherent risk that future exploration or drilling programs may not return an economic result.

- Macro environmental impacts – Macro factors which influence price and sentiment of the commodity. Any macro events or circumstances which negatively impact these metals, could adversely affect TKLs share price.

- Funding risk – TKL is a junior explorer with no revenues to fall back on to fund its exploration. As a result, the company relies on new funding for future exploration programs. There are no guarantees future raises will be undertaken at a higher valuation then todays share price.

- Volatility – The share price of junior explorers is highly dependent on exploration results which may have high volatility