VIRIDIS – COLOSSUS IONIC CLAY POTENTIAL

Viridis Mining and Minerals (ASX:VMM) has been in the spotlight recently due to its recent acquisition of the Colossus Project. In August 2023, Viridis Announced it secured a potential world class Ionic Adsorption Clay (IAC) Rare Earth Element (REE) project covering 90.69km2 in the Poços De Caldas Alkaline Complex, Minas Gerais, Brazil, located within South America’s largest known Alkaline Complex.

Viridis wasted no time in commencing its work program at Colossus, sending a number of samples for preliminary metallurgical testing for Ionic Rare Earths. The results were extremely positive with all Saprolite surface grab samples returning Ionic Mineralisation using single-step Ammonium Sulfate wash of pH 4 at room temperature.

34 shallow auger holes had previously been drilled by the project vendors, to a maximum depth of 3 meters. All 34 holes returned remarkable grades of REE mineralisation, within heavily oxidised clay and humic profiles, including standout results of:

- 3m @ 2,003 ppm TREO from surface (22% MREO) ending in mineralisation

- 3m @ 1,785 ppm TREO from surface (34% MREO) ending in mineralization

- 3m @ 1,997 ppm TREO from surface (22% MREO) ending in mineralization

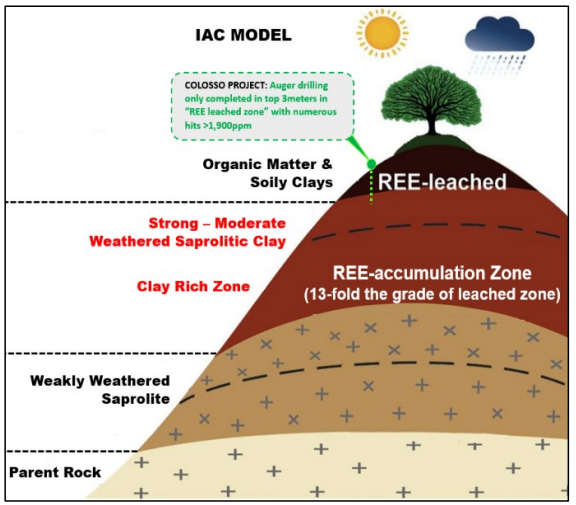

Mineralisation remains open in all directions and at depth; no drilling has been conducted below 3 meters to date, with negligible Uranium and Thorium levels present. Generally speaking, the top 5 meters of an ionic clay profile contains the lowest grades as it holds a mixture of humic and oxidised leached material, whereby REE ions have remobilized downwards into heavily weathered clays.

This provides significant exploration upside for Colossus regarding both depth and grade, during the auger, aircore and diamond drilling programs which are currently underway. At its trading price of $0.89 on 11th October, Viridis Enterprise Value sits at roughly $41,000,000. Let’s look at a peer located very close to Viridis to gauge its future potential.

METEORIC COMPARISON:

Adjoining from Virdis’ Colossus Project, is Meteoric Resources (ASX:MEI), which has secured 193Km2 of Land Holdings[1]. Meteoric boasts an impressive enterprise value of $417,000,000 as at closing price on the 11th of October. Meteoric hosts the world-class Caldeira Ionic Adsorption Clay (IAC) Project which currently has a JORC resource of 409Mt @ 2,626ppm TREO at a 1,000ppm cut off[2] delineated through historic auger drilling completed by JOGMEC.

MEI has extensive drilling results which have proven that in IAC-type deposits, the highest concentrations of REEs are typically located in an intermediate weathered layer. This means that the grades tend to be the lowest in the first 5 meters and then often improve significantly at depths to 50M or more. Meteorics lowest average historical grades of 1812ppm were found below 3m from surface.

Remarkably they increased to an average of 2,810ppm over the next 7 meters down and the highest average grades were found deeper than 30m sitting at 2859ppm. With Viridis having an average grade of 1309ppm under 3m, their future drilling programs which will drill well in excess of 3m, could see similar increases in average grades to Meteoric. The image below from VMM illustrates why higher grades of TREO often occur as depth increases.[3]

METEORIC JOURNEY:

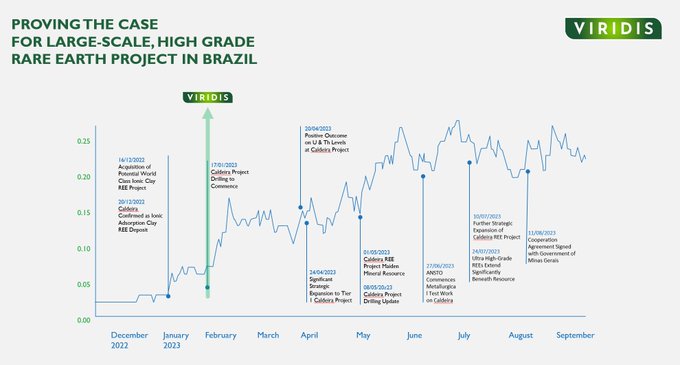

While VMM has only recently announced its Acquisition, we can take a look at the trading history of MEI and see how the market consistently re-valued the stock as it continued to meet relevant exploration and development milestones.

Prior to its acquisition on December 2022, its share price was just $0.016 and has risen over 1,400% over the following 9 month period. Now this doesn’t mean that Viridis will follow the same path or achieve the same outcome, however it’s clear that if Viridis continues to grow its REE project in Brazil, it’s enterprise value can grow substantially from current levels.

Now some may be asking: “why didn’t the vendors offer the project to MEI?” This is explained by the fact that MEI’s vendor, Togni, had an agreement that if any additional land in was acquired within 10km of MEI’s project area, Togni would be entitled to a 4.75% royalty. So if VMM vendors, Varginha, had given the project to MEI they would have lost the royalty. This would also apply to any potential future acquisitions in the area.[4]

FUTURE STEPS FOR VIRIDIS?

Viridis maiden drilling program commenced mid-September with three auger rigs have arrived on site targeting all four priority prospects which adjoin Meteorics Caldeira Resource. Phase I of exploration, which kicked off in late September, will focus on the existing Mining Licenses, which adjoin and extend from the Caldeira Resource’s northern boundary.

This will consist of approximately 3,200 m of drilling comprising 213 Auger holes. Surprisingly, Viridis also announced Phase II drilling commenced prior to the results from their phase I program becoming available.

‘Phase II scope has now been expanded to consist of diamond and air-core drilling to target new areas of the Alkaline Complex at depth, focusing first on Cupim South and Sien prospects’.[5] Auger drilling by JOGMEC intersected 15m @ 3,127ppm TREO, 5 metres away from Cupim South Prospect.[6]

Viridis also continues to work closely with Varginha Parties, to further explore opportunities to acquire additional exploration and mining licenses prospective for IAC Rare Earths in the Poços de Caldas Alkaline Complex.[7]

RISKS?

Funding Risk: Just like all junior mining explorers, Viridis will need to raise capital to develop its REE project. The price that it raises at will be determined by its progress/achievements as well as the market environment.

Market Risk: The rare earth sector is currently ‘hot’, however this could change in the future. If it does, one could expect that it would be difficult for rare earth explorers struggle to maintain share price appreciation.

Drilling success: Even though Viridis has high grade historical drilling results, there are no guarantees future drilling programs will achieve the same level of success.

[1] See ASX announcement dated 10 July 2023, ‘Further Strategic Expansion of Caldeira REE Project’. [2] See ASX announcement dated 1 May 2023 – ‘Caldeira REE Project Maiden Mineral Resource’. [3] See ASX announcement dated 1 August 2023 – ‘VIRIDIS ACQUIRES POTENTIAL TIER ONE IONIC CLAY RARE EARTH PROJECT’. [4] See Announcement dated 13 March 2023, ‘Caldeira Project Definitive Acquisition Agreement Signed’. [5] See ASX announcement dated 3 October 2023, ‘PHASE II DRILLING COMMENCES AT COLOSSUS IONIC CLAY PROJECT’ [6] See ASX announcement dated 1 May 2023 ‘Caldeira REE Project Maiden Mineral Resource’ [7] See ASX announcement dated 14 August 2023, ‘VIRIDIS SECURES MAJOR EXPANSION OF THE COLOSSUS RARE EARTH PROJECT’

In the interest of full transparency, Phoenix Global or its associates own a significant amount of shares. In addition to this, Viridis is a client of Phoenix Global Investments & Phoenix is paid a fee by all stocks mentioned. No information is personal financial advice & all information is general in nature. Please remember all content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our Website and wish to rely upon, whether for the purpose of making an investment decision. The research provided in this article is considered to be reliable and is accurate as of the publication date. This research is also based on the authors opinion and is not meant to represent the opinion of Viridis Mining and Minerals Ltd.